Uniswap is witnessing an uptick in its price, showing a 27% increase over the last month and 12% last week. These positive signs point to a growing confidence among investors. The market cap of Uniswap has also jumped significantly by 32% within the past 30 days, underlining the increasing interest and investment in this DEX protocol.

The trading volume, however, tells a more nuanced story. While the last month saw a substantial increase in volume by 63%, there have been notable declines in the shorter term. This indicates a fluctuation in trading activity, which could be attributed to short-term market uncertainty or shifts in investor focus. Despite these fluctuations, the overall volume trend suggests an increasing engagement from the trading community.

Uniswap Technical Indicators

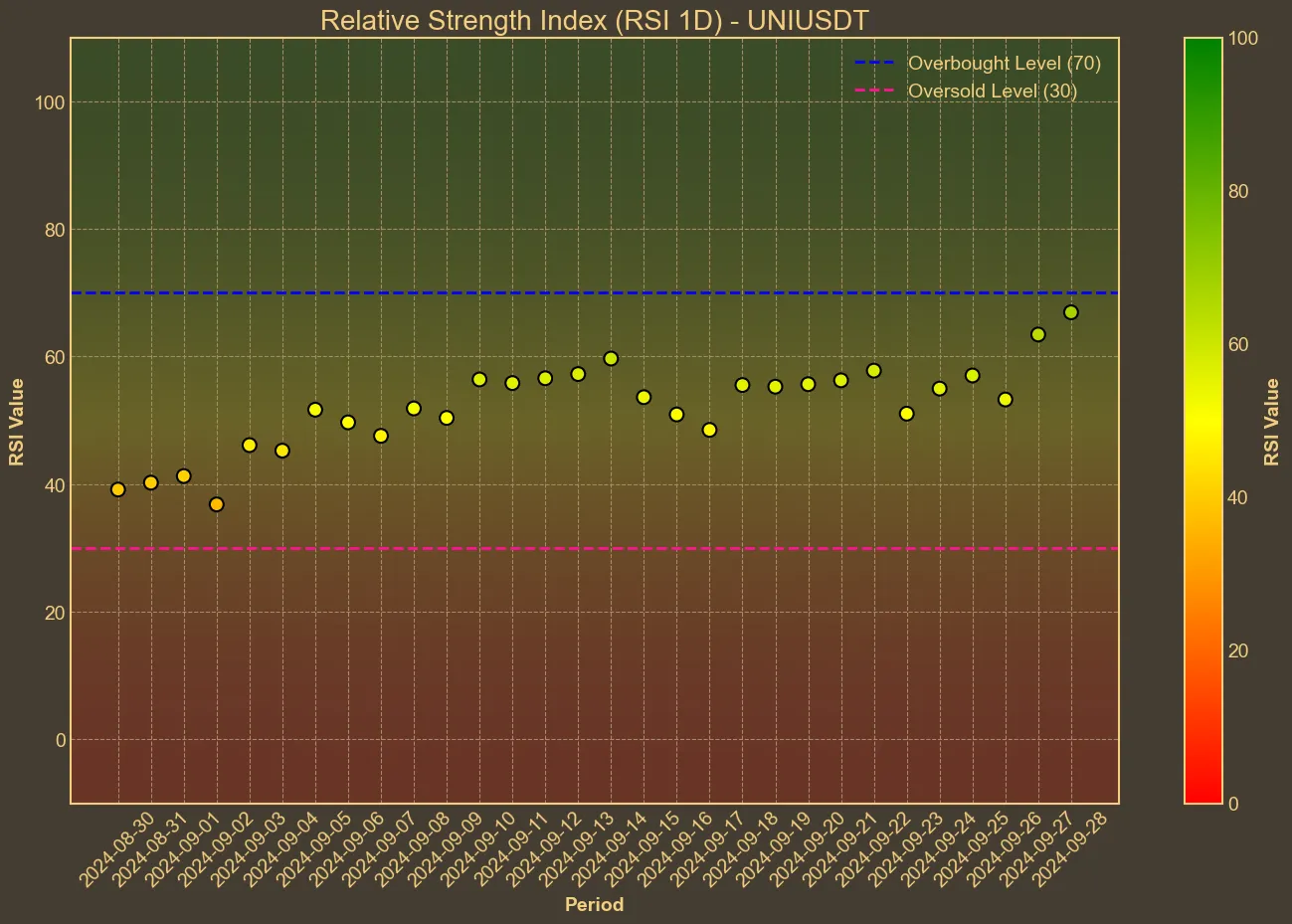

Looking at the technical indicators, Uniswap seems to be in a healthy state. The Relative Strength Index (RSI) is sitting at 67, suggesting that the asset is approaching overbought conditions but is not there just yet. This aligns with the recent price increases and could signal further upward potential if buying continues. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are trending upwards, indicating a positive momentum. The current price is positioned between the Bollinger Bands, which might suggest that the price is relatively stable in the short term.

The MACD (0.24) remains above its signal line (0.14), further supporting the bullish sentiment. Similarly, the Awesome Oscillator (AO) is positive, which often signals the beginning of a price uptrend. This combination of indicators generally projects a strong bullish outlook.

Market Implications

The recent data and technical analysis of Uniswap point towards a positive trend, reflecting investor confidence and potentially higher price movements in the future. However, the fluctuations in trading volume and the fact that the price is nearing overbought conditions as per RSI should be monitored closely. Despite the optimistic signs, it is crucial to remember that technical analysis has its limitations. It doesn’t account for sudden market changes or external factors that could impact prices.

While the current indicators are promising, it’s vital for investors to stay cautious – some technical indicators are warning about a possible correction in the coming days. However, analyzing the bigger picture outside the technicals, the favorable macroeconomic situation for the whole crypto market might overcome this and push Uniswap towards $10.