Uniswap, the largest decentralized exchange on the Ethereum blockchain, has struggled this year with its UNI coin. Currently priced near $7.50, it has dropped by over 35% in the past month.

Despite maintaining a high market cap of $4 billion and solid trading volume of $0.4 billion, investor sentiment remains cautious. Recent positive developments have not been enough to improve the outlook for UNI.

Table of Contents

Momentum Indicators

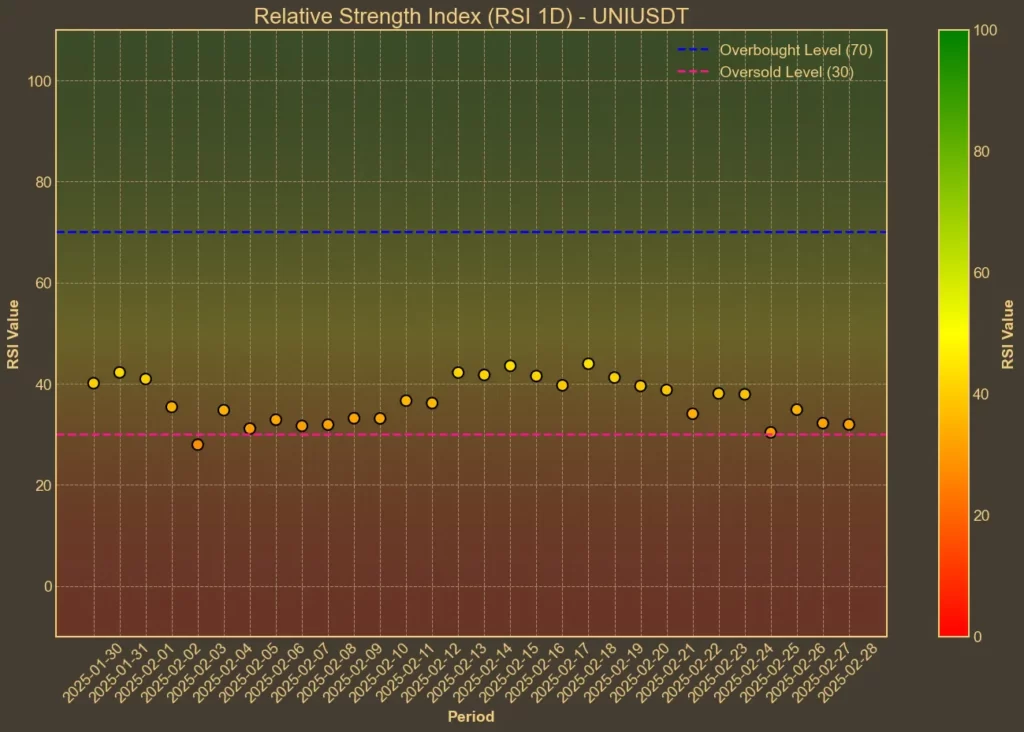

RSI: Oversold

The Relative Strength Index (RSI) indicates oversold conditions. RSI(14) has dropped to 29, down from 32 yesterday and 34 a week ago. Short-term RSI(7) is even lower at 22. This suggests that selling pressure has been intense, potentially setting the stage for a short-term rebound as oversold conditions often lead to a corrective bounce. However, it is crucial to remember that an oversold RSI doesn’t guarantee an immediate recovery.

MFI: Extremely Oversold

The Money Flow Index (MFI), which combines price and volume data, shows extremely oversold levels. MFI(14) is at a very low 8, significantly down from neutral 52 a week ago. This indicates significant outflows of capital and a bearish sentiment dominating the market. The extremely low value suggests that selling might be overextended, but without a shift in volume dynamics, a reversal is uncertain.

Fear & Greed Index: Extreme Fear

The crypto market’s Fear & Greed Index is currently at 16, indicating a high level of fear among investors. While this is an improvement from yesterday’s record low of 10, the general sentiment remains negative, especially considering price action of the biggest coins. Current fear might lead to more selling pressure, but it can also provide buying opportunities for confident investors.

Moving Averages

SMA & EMA: Bearish

Both Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) reflect a bearish outlook. The SMA(9) is at 8.4 and EMA(9) at 8.3, both above the current price. Similarly, the longer-term SMA(26) is at 9.1 and EMA(26) at 9.3, further emphasizing downward pressure. This suggests a continuation of the bearish trend unless the price breaks above these levels, signaling potential recovery.

Bollinger Bands: High Volatility

Bollinger Bands are showing increased volatility. The upper band is at 10.65, and the lower band is at 7.54. With the current price closer to the lower band, UNI appears oversold, increasing the possibility of a short-term bounce. However, if the price falls below the lower band, it could signal a continuation of the downtrend.

Trend & Volatility Indicators

ADX: Strong Trend

The Average Directional Index (ADX) currently stands at 41, reflecting a strong downward trend. This indicates that the ongoing bearish momentum is robust, and a trend reversal is unlikely until the ADX value decreases significantly.

ATR: Stable Volatility

The Average True Range (ATR) is at 0.83, consistent with values from the past week. This indicates stable volatility, meaning price fluctuations are steady but still within a bearish context.

AO: Bearish Momentum

The Awesome Oscillator (AO) is negative at -1.63, having declined from -1.45 yesterday and -1.18 a week ago. This shows increasing bearish momentum, reinforcing the downtrend.

VWAP: Bearish

The Volume Weighted Average Price (VWAP) is at 12.91, which is significantly above the current price. This indicates selling pressure and suggests that market sentiment remains bearish.

Relative Performance

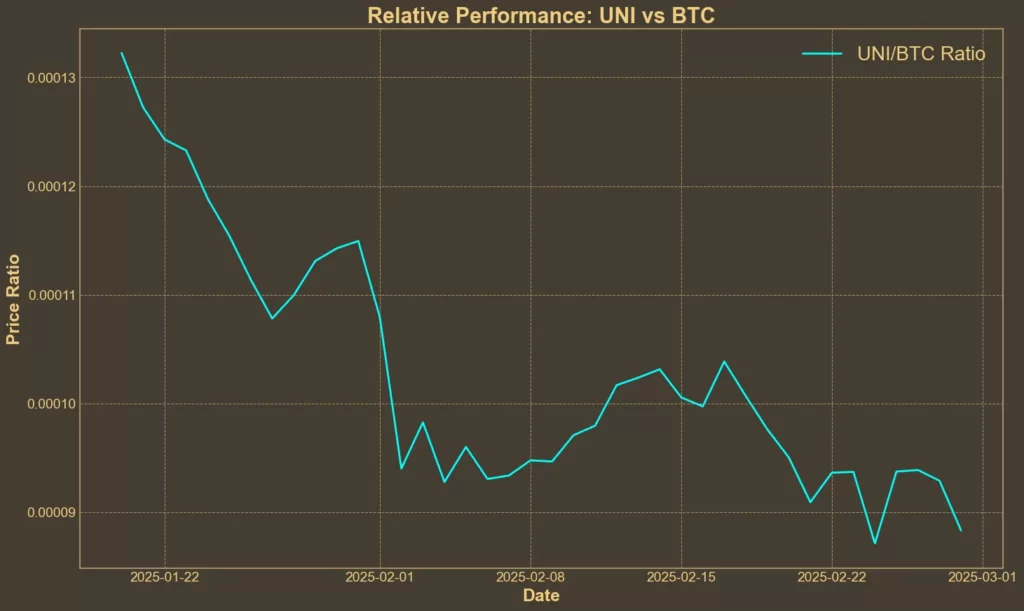

Comparison Against BTC: Falling

Uniswap’s performance against Bitcoin continues to weaken. The UNI/BTC ratio has declined by 2.7% in the past week and 22.6% over the last 30 days. Even though Bitcoin itself has seen a significant pullback, UNI’s underperformance shows its relative weakness.

Positive Developments Are Not Enough

Despite losing nearly 20% over the last week and 7% today, Uniswap has seen some positive news recently. The SEC dropped its investigation, which briefly boosted UNI’s price, but the rally was short-lived. This decision is likely to benefit Uniswap in the long run, but it hasn’t been enough to restore investor confidence amid the current bearish market sentiment.

Uniswap also announced a partnership with Robinhood, Moonpay and Transak, aimed at improving crypto accessibility. Although this is a significant development, it failed to shift market sentiment, likely due to the prevailing extreme fear among investors.

What’s Next?

Uniswap’s technical indicators paint a bearish picture. While momentum indicators like RSI and MFI suggest oversold conditions, the lack of bullish signals from trend and moving averages implies continued downward pressure. The strong ADX value indicates a sustained bearish trend, and the negative AO confirms ongoing momentum in that direction.

Despite the pessimistic short-term outlook, oversold conditions could spark a short-term corrective rally. However, this would likely be temporary unless broader market sentiment improves. While Uniswap remains a promising project with strong long-term potential, its short-term price action will likely remain under pressure.