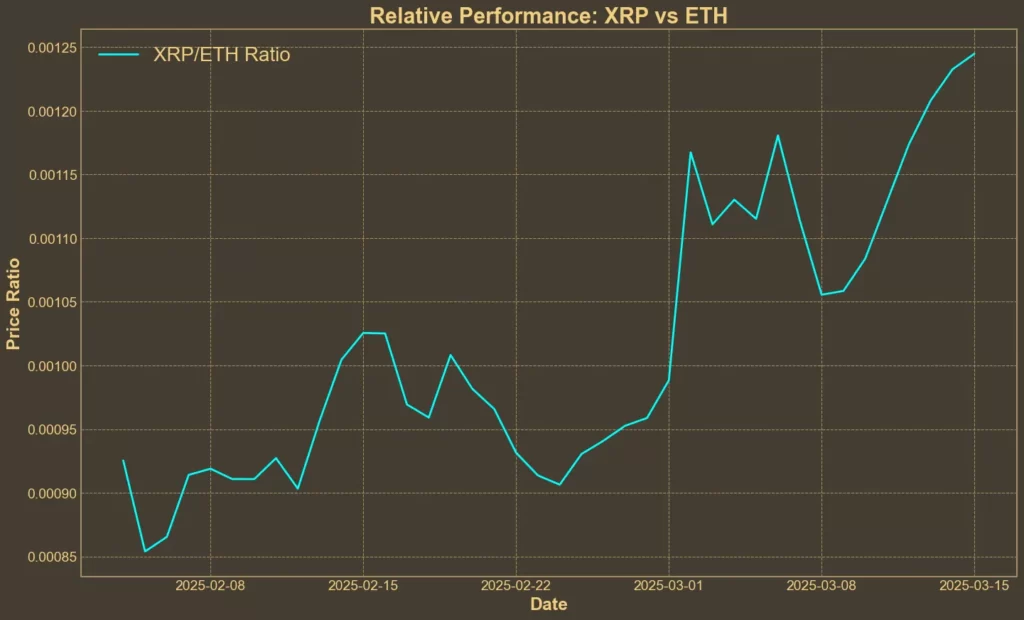

Despite volatility in the crypto market driven by the escalating trade war, XRP has remained resilient, slipping just 0.5% in the past month. With a market cap above $140 billion, it now stands at more than half of Ethereum’s valuation and is approaching Tether’s USDT. Moreover, the XRP/ETH ratio has reached levels last seen in 2020. Can this momentum hold?

Table of Contents

Momentum Indicators

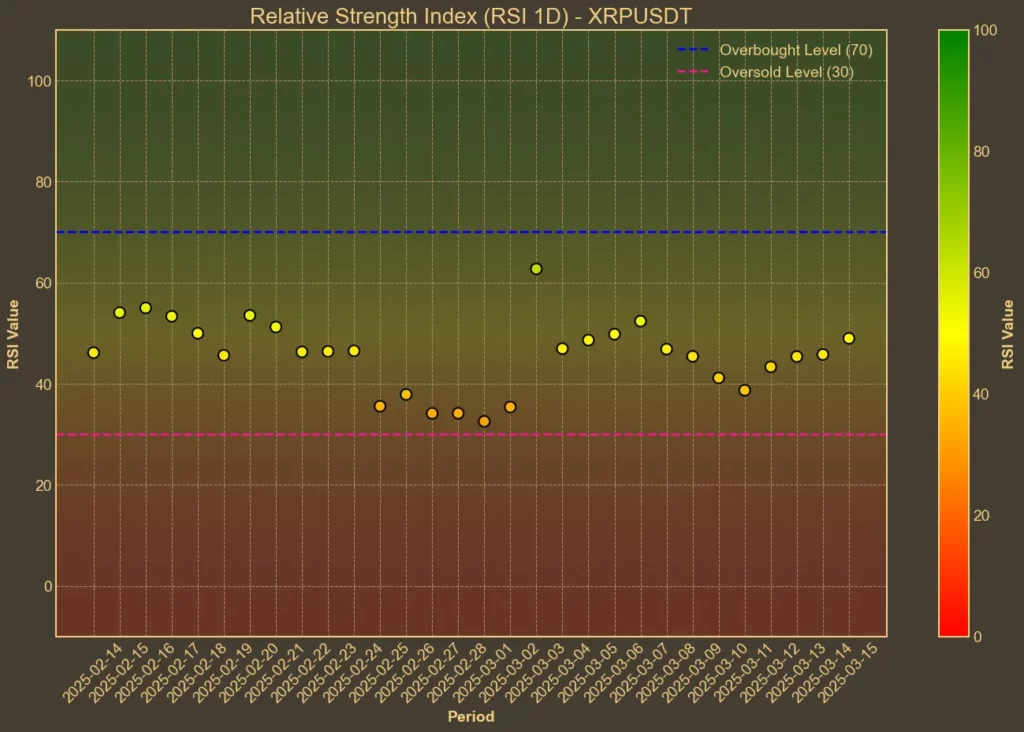

RSI: Neutral

The Relative Strength Index (RSI) measures whether an asset is overbought or oversold. RSI(14) is currently 51, slightly above yesterday’s 49, showing moderate buying momentum. Short-term RSI(7) stands at 57, compared to 53 yesterday. This suggests mild bullish sentiment but does not indicate strong buying pressure.

MFI: Neutral

The Money Flow Index (MFI) incorporates volume into its analysis of buying and selling pressure. MFI(14) remains at 51, the same as yesterday, but significantly higher than one week ago when it was at 28. This reflects increased capital inflow into XRP, supporting the price’s recent stability.

Fear & Greed Index: Neutral

The Fear & Greed Index measures overall crypto market sentiment. Today’s value is 46, compared to 27 yesterday and 28 last week. This shift suggests a recovery in investor confidence, although it remains below the threshold for strong bullish behavior.

Moving Averages

SMA & EMA: Cautiously Bullish

Moving averages help assess the trend direction over different time frames.

- SMA(9) today: 2.26

- EMA(9) today: 2.31

- SMA(26) today: 2.39

- EMA(26) today: 2.39

XRP is currently trading above the 9-day moving averages but near the 26-day averages, indicating that the short-term trend remains bullish while the longer-term trend is still stabilizing.

Bollinger Bands: Neutral

Bollinger Bands highlight periods of high and low volatility. The upper band stands at 2.72, while the lower band is at 1.94. Since XRP is trading in the middle of this range, there is no immediate signal of overbought or oversold conditions, though it suggests room for price expansion in either direction.

Trend & Volatility Indicators

ADX: Weak Trend Strength

The Average Directional Index (ADX) measures trend strength. ADX(14) is currently at 21, slightly lower than 22 yesterday and 24 one week ago. A weakening ADX indicates that the current trend lacks strong momentum, making it vulnerable to reversals.

ATR: Low Volatility

The Average True Range (ATR), a volatility gauge, is 0.23 today, unchanged from yesterday but slightly lower than 0.25 last week. This suggests that price swings have become more controlled, reducing the likelihood of sudden breakouts.

AO: Bearish Momentum

The Awesome Oscillator (AO), which confirms trend direction, is currently -0.18, slightly improving from -0.24 yesterday but weaker than -0.02 a week ago. Negative values suggest bearish momentum, though the upward shift hints at possible stabilization.

VWAP: Bullish

The Volume Weighted Average Price (VWAP), which measures the average price considering trading volume, stands at 2.55. Since XRP’s current price is below VWAP, this suggests the potential for further upside if volume returns.

Relative Performance

Comparison Against ETH: Stronger Performance

The XRP/ETH ratio now stands at 0.00125 – a level last seen in 2020. It has risen 18% in the past seven days and 24% over the last month.

XRP’s market cap has now surpassed half of Ethereum’s, but it’s worth noting that this shift is largely due to Ethereum’s weak performance rather than exceptional strength from XRP.

What’s Next for XRP?

XRP’s technical indicators present a mixed but slightly bullish outlook. Momentum indicators suggest stable buying pressure, while moving averages provide mild support for the current trend. However, declining volume and a weakening ADX indicate that this rally lacks strong momentum. If buyers step in and push XRP above $2.50, it could test higher resistance levels.

That being said, given the recent volatility and poor performance of Ethereum and Solana in the past weeks, XRP’s neutral outlook itself signals strength and resilience – which could set the stage for a stronger move when market momentum improves.

XRP’s outlook might also improve further if the SEC vs. Ripple lawsuit ends with a favorable outcome – something many investors are hoping for. If you’re out of the loop, we break down everything you need to know about the case and where it stands in this article.