1Fuel has recently attracted attention for its promises and promotions. This token appears in sponsored articles, press releases, and eye-catching statements about growth potential. However, our research has uncovered several significant concerns that you should consider before investing in this project.

Table of Contents

About 1Fuel Presale

1Fuel is a project that aims to provide a cross-chain wallet system, a one-click feature to simplify blockchain usage, and a presale offering that claims half of its entire token supply. It describes itself as fresh, aiming to solve the confusion of juggling multiple wallets. That pitch might appear strong, yet there are several points that need more clarity.

The presale structure raises concerns. Allocating 50% of the total tokens to the presale means a significant portion of tokens will be held by early investors. Should these buyers decide to sell all at once, the token could face major price swings. While it is not unusual for some new projects to allocate a big chunk of tokens to presales, the risk for smaller investors should not be overlooked.

Whitepaper Issues

Although the 1Fuel whitepaper is extensive, it lacks the concrete technical details one would anticipate from such a document. Much of the content is repetitive, and the descriptions remain superficial without providing substantial evidence of progress or completed work. Let’s examine these concerns in detail:

Content Repetition

One of the primary issues is the frequent repetition of content. For instance, in the Introduction section, entire paragraphs convey the same message but are simply rephrased:

There are more instances of this only in the Introduction section alone. But when we go further, it gets no better:

Lack of Depth

At first glance, the whitepaper may seem impressive with its descriptions of mathematical models and provided code examples. However, upon closer examination, significant shortcomings become apparent.

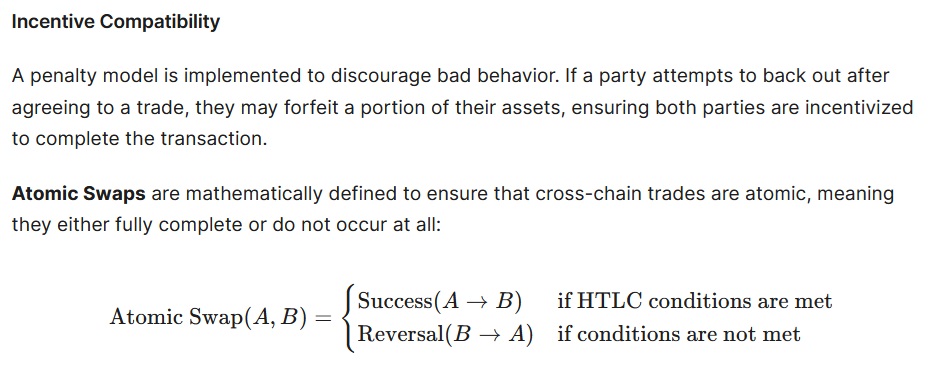

The Python examples are overly simplistic and not practical for developing a sophisticated cryptocurrency wallet with cross-chain and peer-to-peer functionalities. For instance, cross-chain transactions are depicted as basic graph optimizations, omitting critical elements like interoperability protocols, smart contract interactions, and atomic swaps. Additionally, essential features such as Multi-Party Computation (MPC), Hashed Time-Locked Contracts (HTLCs), and secure element chips mentioned in the whitepaper are absent from the provided code.

Similarly, the sections on mathematical models are superficial. The whitepaper introduces fundamental concepts without getting into the detailed mechanisms necessary for real-world blockchain and cross-chain transaction systems:

Is the Whitepaper AI-Generated?

The whitepaper’s vagueness and repeated sections raise suspicions that parts of it may have been generated by AI without proper context or integration. While there is no definitive method to confirm if AI was used in its creation, several aspects suggest this possibility.

Firstly, the language used feels unnatural and excessively relies on terms commonly associated with AI-generated text. Additionally, many sections are formatted with bullet points – a style frequently employed by chatbots like ChatGPT. The repetition of similar messages across different sections using bullet points further heightens suspicion.

Moreover, certain sections, such as “Optimization and Extension” within the feature descriptions, are written in an imperative tone. They don’t sound like plans from developers but instead resemble a list of external suggestions or tasks.

In conclusion, the issues identified in the whitepaper raise serious suspicions. Not only does it lack detailed information or blueprints about the project, but the document also gives the impression that the text may have been pieced together using AI.

Anonymous Team

The whitepaper claims that the team comprises industry experts, leaders with experience in technology companies, and advisors who are “some of the most respected names in the blockchain and financial industries”.

If true, revealing the team members would significantly bolster the project’s credibility. However, the whitepaper states that “the identities of the team members will remain confidential until 80% of the presale target is reached”.

Currently, there is no information about who is behind the project. No names are listed on the website, and the domain ownership remains hidden. This lack of transparency is a serious concern. Without identifiable team members to hold accountable, investors will be vulnerable should any issues arise.

No Audits

The whitepaper asserts that “To maintain a high level of security, the 1FUEL Wallet undergoes regular security audits conducted by independent third-party firms”. It elaborates on processes like code reviews, penetration testing, and compliance checks. However, no audit reports, either internal or from third-party companies, are available for review.

When we contacted 1Fuel’s chat system to inquire about audit reports, the representative responded that the website is still under construction and they do not have an audit available at this time. While some projects arrange audits later, this absence is concerning for investors who are being asked to contribute funds without essential security assurances.

Sponsored Articles and Promotion

When we searched online for coverage of this presale, most articles or posts mentioning 1Fuel had disclaimers that they were “paid releases” or “sponsored”. The articles we stumbled upon were using deceptive tactics to lure investors, such as promising unrealistic 2000% gains or suggesting that XRP faces market pressure due to 1Fuel presale raising $500K, despite XRP having a market cap exceeding $130 billion.

Usage of such manipulative tactics in media covering is common among other suspicious presales. We’ve covered how such articles are built here. If you’re new to crypto, we strongly recommend checking it out.

Additionally, while there are numerous articles promoting the presale, organic discussions about 1Fuel on social media are virtually nonexistent. We were unable to find any posts about this project on platforms like Reddit, aside from mentions in sponsored articles. This lack of genuine engagement is another red flag, indicating that the project may not be as popular or well-supported as some media sources suggest.

Referral Program and Pressure

1Fuel offers a referral program with very high bonuses. Referral programs in the crypto world can be harmless, yet a scheme that promises large payouts for inviting new participants sometimes raises questions of sustainability. If these rewards are not backed by tangible value, a project might hinge on continuous recruitment of fresh funds.

We also did not see many details about how these bonuses work on a practical level. For instance, it is not clear whether the project has safeguards in place to limit exploitation or whether tokens distributed through these bonuses will remain locked for a certain period. Without more detail, it is tough to judge how fair the token distribution will be, especially if many tokens end up concentrated in the hands of a few promoters.

Summary

Currently, 1Fuel presents several serious red flags. The whitepaper raises significant concerns about the project’s legitimacy, there are no available security audits, and despite bold claims, the team remains anonymous. Additionally, the project relies heavily on promotional articles and has minimal organic presence online. The large allocation of tokens to the presale and the referral program also pose further questions.

If you are considering investing in this project, it may be wise to wait for further developments. The project could gain legitimacy by updating the whitepaper with more technical details, providing audit reports, and disclosing the team members. However, until these issues are addressed, 1Fuel exhibits numerous red flags, making the investment highly risky.

Sadly, many crypto presales are scams

We have a section on our website focused on uncovering red flags in ongoing presales to help potential investors stay safe. If you are interested in investing in presales, you might find it worthwhile to read our other investigations, even when you’re not intending to invest in those particular coins – you’ll start to notice repeating patterns and learn the tricks that suspicious presales use.

You should also always search phrases like “is [presale coin] a scam” and check Reddit forums. If you find content warning about the presale – or no community whatsoever – you should seriously consider whether the presale is legit. When in doubt, you can also contact us – we’ll be happy to investigate the presales that you’re interested in!