The cryptocurrency market’s spotlight remains firmly on Bitcoin, a testament to its dominance in the digital currency space. With its current price hovering around $66,000, Bitcoin is tantalizingly close to its all-time high of $73,781.

Throughout most of September, Bitcoin struggled to stay above $60,000, briefly dipping below $53,000 during a sharp market pullback, compounded by a 7% drop in NVIDIA’s stock. However, a significant shift occurred when the Federal Reserve cut interest rates by 0.5%, sparking a consistent upward trajectory for Bitcoin. This surge has lifted the entire cryptocurrency market, including altcoins. Yesterday, China’s economic stimulus – injecting billions into its economy – fueled additional gains, propelling Bitcoin past the $65,000 threshold. As of today, Bitcoin has crossed $66,000, with other cryptocurrencies following suit, including meme coins, which have seen double-digit growth.

Technical Analysis and Predictions

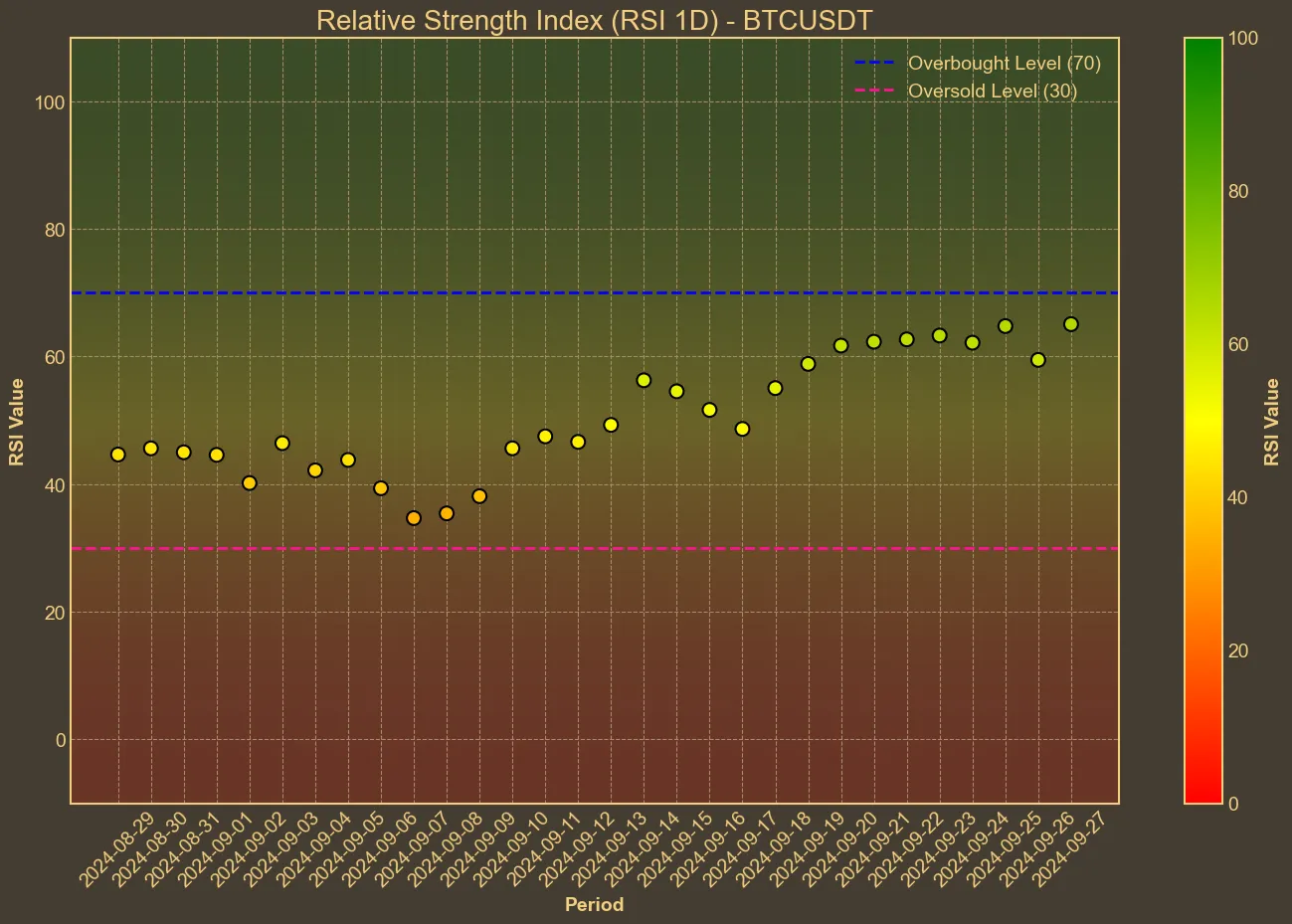

The Relative Strength Index (RSI) offers insights into the market’s sentiment. Currently sitting at 67, the RSI is steadily climbing, indicating strong buying pressure without entering overbought territory.

Bitcoin’s key technical indicators continue to point to a bullish trend. Both the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are moving upward, with the SMA at 59,956 and the EMA at 61,491. These positive signals are reinforced by the Moving Average Convergence Divergence (MACD), where the MACD line (1,610) maintains a healthy gap above the signal line (1,045).

Further evidence of potential upward movement comes from the Bollinger Bands. Bitcoin’s price is approaching the upper band at 67,063, signaling the possibility of a breakout. The Average Directional Index (ADX) also points to a strong trend, while the Awesome Oscillator (AO) shows increasing positive momentum for the past week, suggesting further gains could be on the horizon.

Final Thoughts

The technical outlook for Bitcoin is overwhelmingly positive, supported by favorable macroeconomic conditions. Historically, Bitcoin has performed well in the months following a halving event, leading many to believe that the bullish phase has just begun. While the cryptocurrency market remains highly volatile, current indicators suggest that Bitcoin could soon be testing new historical highs.