Bitcoin has slipped below the critical $100,000 level, dragging other major cryptocurrencies into a defensive position. This marks the second correction of its kind this week – the first being triggered by the DeepSeek revolution. While Bitcoin briefly managed to reclaim $106K afterward, it has once again fallen below the threshold.

Table of Contents

Why Is Bitcoin Down?

The decline is largely tied to broader macroeconomic factors, particularly the latest wave of tariffs imposed by the U.S. government. President Donald Trump’s executive order targeting imports from Canada, Mexico, and China has fueled renewed fears of an extended trade war. Expectations are growing that similar tariffs will soon be imposed on the European Union, adding further pressure on global financial markets – including crypto.

Investors have also taken a more cautious stance as the Crypto Fear & Greed Index dropped to a neutral 47, reflecting growing uncertainty. Earlier this month, Bitcoin saw a surge in trading volume, but that momentum has faded, suggesting a cooling of investor enthusiasm. Analysts have also warned of potential short-term pullbacks, reinforcing the cautious sentiment.

Adding to the pressure, liquidation activity has intensified, with leveraged traders increasing their sell-offs. This has only added to Bitcoin’s struggle to maintain key support levels.

Technical Indicators Show Mixed Signals

From a technical perspective, Bitcoin’s recent price movement presents a mixed outlook. The price currently hovers around $99,500, but several indicators suggest Bitcoin could be facing short-term issues.

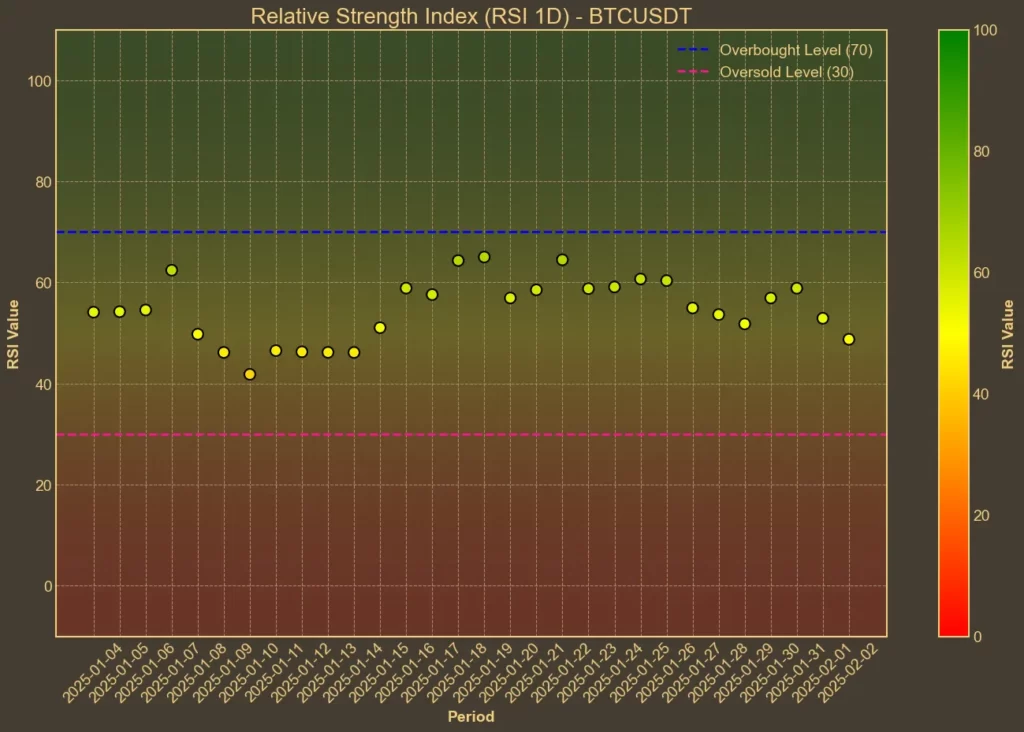

The Relative Strength Index (RSI) has declined to 46 after sitting at higher levels earlier in the week, signaling a more neutral stance.

Meanwhile, moving averages show a similar trend – while the Simple Moving Average (SMA) sits just below the current price, the Exponential Moving Average (EMA) has begun to tilt downward.

Another concerning factor is the Moving Average Convergence Divergence (MACD), which has slipped below its signal line, hinting at a bearish outlook. At the same time, Bollinger Bands have tightened, reducing volatility but also setting the stage for a potential breakout in either direction.

Trading Volume and Market Cap Trends

Bitcoin’s trading volume has seen notable swings, with a 24% increase over the past 24 hours, but a broader decline of 8% over the past month. Market capitalization has also slipped, dropping 0.7% in the past day and 5.3% over the past week, settling at $1.98 trillion.

Despite the price drop, there’s still evidence of strong market engagement. Over the last three days, trading activity has surged, suggesting that investors are actively responding to these fluctuations rather than exiting the market entirely. However, the week-long decline in market cap highlights an overall cautious approach.

Institutional Interest Remains Strong

While Bitcoin has faced short-term setbacks, institutional interest remains high. New ETFs are being introduced – recently a hybrid Bitcoin-Ethereum ETF by Bitwise was approved. Moreover, firms like MicroStrategy continue to accumulate Bitcoin, further reinforcing confidence in the asset’s long-term potential.

Another factor worth watching is Bitcoin’s supply dynamics. Exchange balances continue to decline while institutional holdings grow, lowering the available supply. Historically, this has created upward price pressure over time. Once the current uncertainty stabilizes, this supply squeeze could help Bitcoin recover and push toward new highs.

Moreover, speculation around a potential U.S. Bitcoin Reserve remains strong. Senator Cynthia Lummis, who now chairs the Senate Banking Subcommittee on Digital Assets, is a vocal advocate for such a reserve. In July, she introduced a bill outlining preliminary details, suggesting that the reserve could purchase 200,000 Bitcoins annually until reaching 1,000,000 BTC – nearly 5% of Bitcoin’s total supply. However, nothing has been officially confirmed, and these figures may be subject to change.

Conclusion

Bitcoin’s drop below $100K is largely driven by escalating trade tensions, which are impacting not just crypto but broader financial markets as well. In the short term, technical indicators suggest a cautious outlook, but institutional support and tightening supply could pave the way for a recovery. The possibility of a U.S. Bitcoin Reserve remains a promising factor for Bitcoin’s long-term prospects.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!