Bitcoin has seen a sharp pullback recently, falling to $82,000 with a 3% loss in the past day and an 11% drop over the week. This decline aligns with a broader trend of weakening momentum.

Despite this correction, its market cap remains strong at $1.63 trillion, still well above pre-election levels. The key question now: Is this just a temporary setback, or are further declines ahead?

Table of Contents

Why Is Bitcoin Falling?

A key factor behind Bitcoin’s recent drop is investor disappointment over the U.S. Strategic Bitcoin Reserve. Many had expected the government to begin purchasing Bitcoin, but instead, the reserve will only include seized BTC holdings, with no immediate plans for additional acquisitions.

The first White House Crypto Summit also failed to deliver any major surprises. While the discussions confirmed previous statements, no significant new developments emerged. Details of the closed-door sessions remain unknown, but so far, the only concrete outcome has been Coinbase’s announcement of a major hiring push.

Beyond crypto-specific events, global macroeconomic uncertainty continues to weigh on the market. The escalating trade war has made investors more cautious, as tariffs put pressure on personal and corporate finances, reducing appetite for riskier assets like Bitcoin. With the final scope of these tariffs still unclear, many investors are hesitant to make major moves, adding to the uncertainty.

Momentum Indicators

RSI: Weak

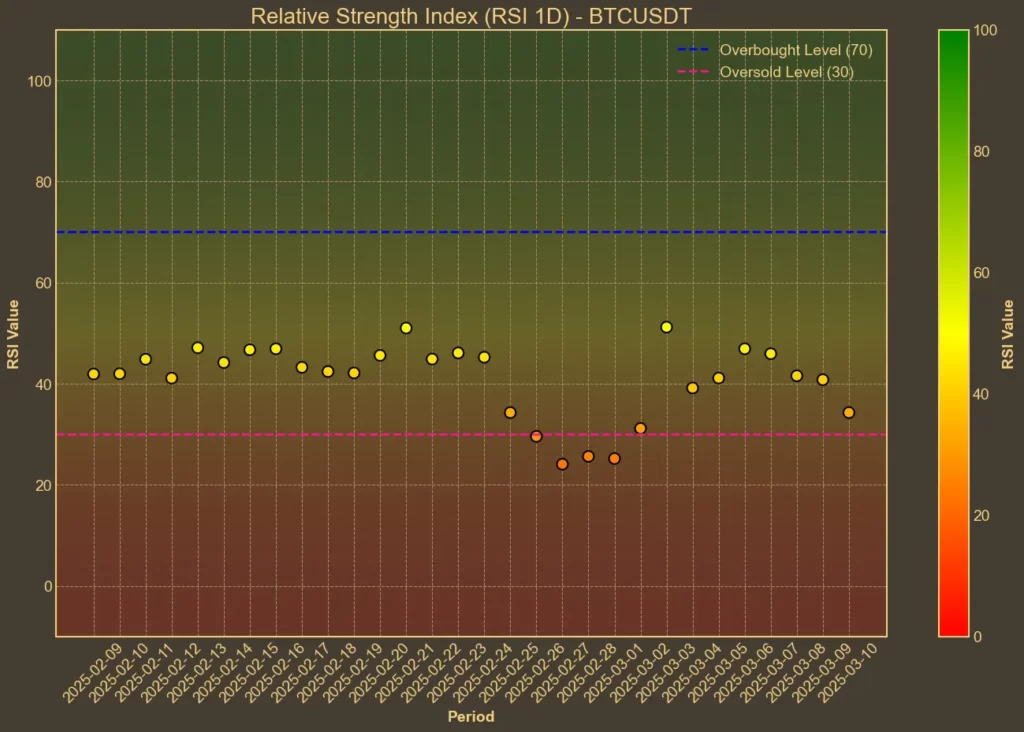

The Relative Strength Index (RSI) gauges whether Bitcoin is overbought or oversold. A value below 30 suggests oversold conditions, while above 70 indicates overbought levels.

Today’s RSI(14) stands at 37, up slightly from yesterday’s 34, but down from 39 a week ago. The short-term RSI(7) is 35, slightly recovering from 30 yesterday. These numbers suggest that Bitcoin is approaching oversold territory, but without strong buying momentum.

MFI: Oversold

The Money Flow Index (MFI) incorporates volume into its overbought/oversold assessment. Today’s MFI(14) is 25, an increase from 24 yesterday and 22 a week ago. This suggests that selling pressure has dominated, but the indicator is nearing a level where a potential rebound could begin.

Fear & Greed Index: Extreme Fear

This indicator measures overall market sentiment, with lower values reflecting fear and higher ones signaling greed. Today’s Fear & Greed Index is 20, down from 33 a week ago. The past few days have seen a steady decline in sentiment, with values dropping from 34 to 15 before stabilizing again at 20. Market participants are clearly on edge, which could mean further price drops or a potential reversal if confidence returns.

Moving Averages

SMA & EMA: Bearish

Moving averages provide insight into Bitcoin’s overall trend.

- SMA(9) today: 87,141

- EMA(9) today: 85,859

- SMA(26) today: 91,041

- EMA(26) today: 89,995

With both short-term averages below their longer-term counterparts, the trend remains bearish. A recovery above the EMA(9) would be the first sign of stabilization, but Bitcoin still has a long way to go before breaking the current downtrend.

Bollinger Bands: Increased Volatility

Bollinger Bands measure price volatility. Today, the upper band is 99,880, while the lower band sits at 78,902. Bitcoin’s price is moving closer to the lower band, suggesting oversold conditions. If it breaks below this level, the market could see further downward pressure.

Trend & Volatility Indicators

ADX: Weakening Trend

The Average Directional Index (ADX) measures the strength of a trend. A high ADX suggests a strong trend, while a low ADX indicates weak momentum. Today’s ADX(14) is 35, the same as yesterday but down from 41 a week ago. This suggests that the bearish trend is losing strength, but there isn’t a clear reversal yet.

ATR: Stable Volatility

The Average True Range (ATR) tracks volatility. Today’s ATR(14) is 4,814, down slightly from 4,870 yesterday, but up from 4,658 a week ago. Volatility remains high, but it isn’t increasing dramatically, meaning traders should expect sharp price swings in both directions.

AO: Bearish Momentum

The Awesome Oscillator (AO) is used to confirm trend momentum. Today’s AO is -6,472, compared to -5,650 yesterday and -9,161 a week ago. While still negative, indicating bearish pressure, the smaller loss compared to last week suggests that downward momentum is slowing.

VWAP: Bearish

The Volume Weighted Average Price (VWAP) is 96,360, significantly above the current price. This indicates that Bitcoin is trading below its volume-adjusted fair value, which could either signal a buying opportunity or suggest further downside if bearish sentiment persists.

Conclusion

Bitcoin’s technical indicators point to weak momentum, with RSI and MFI approaching oversold levels, while moving averages confirm a bearish trend. The Fear & Greed Index remains low, and while the ADX suggests weakening trend strength, it has yet to signal a reversal. Investor disappointment over the U.S. Bitcoin Reserve and ETF outflows has only added to the uncertainty.

For now, Bitcoin remains under pressure. A true recovery would require a breakout above key moving averages and a shift in market sentiment – neither of which is visible yet.

Are you investing in crypto presales? We’ve launched Presale Index – your go-to resource for checking if a project is legit before you invest. Don’t get caught in a scam – look it up in our index first!