The cryptocurrency market is facing another wave of volatility, with prices dropping sharply across the board. Bitcoin has fallen below $80,000 – a level not seen since November – while Ethereum, XRP and Solana are struggling to hold key support levels. What’s driving this downturn, and what does it mean for investors?

Table of Contents

Bitcoin Below $80,000

Bitcoin, the largest cryptocurrency by market cap, has lost 20% over the past week and 7% just today. It’s now trading below $80,000, a psychological barrier that had previously been a strong support level.

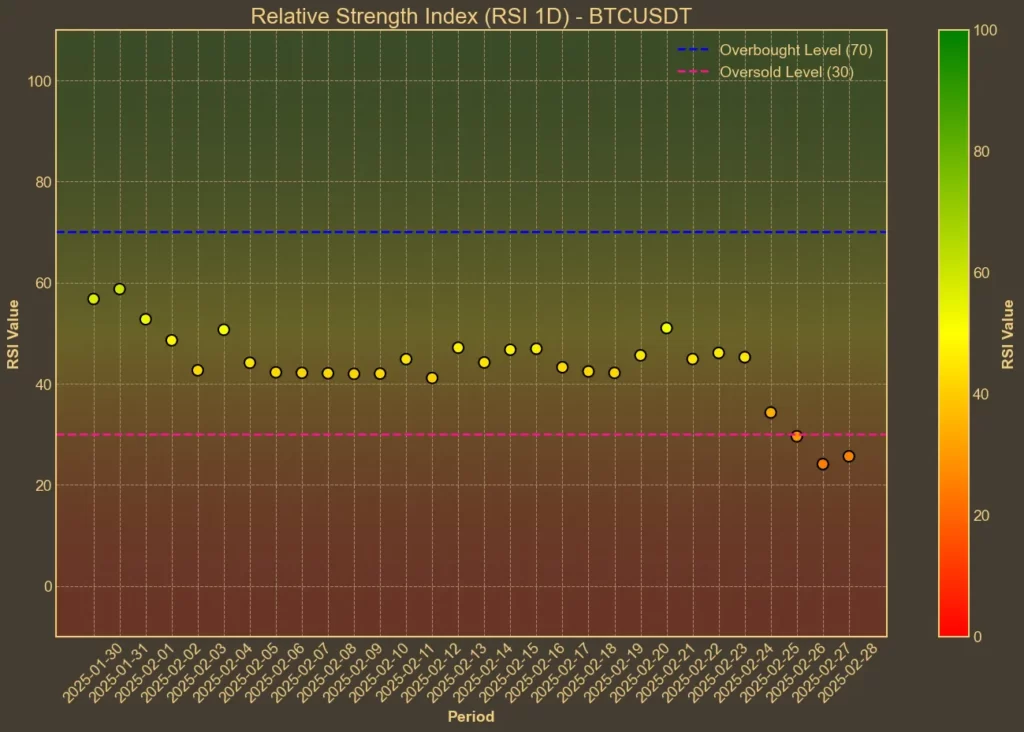

From a technical perspective, Bitcoin is oversold. The Relative Strength Index (RSI), a tool used to gauge whether an asset is overbought or oversold, is at 21 on the 14-day scale. This is a sharp drop from 45 just a week ago and suggests that Bitcoin may be due for a bounce, at least in the short term.

However, the 7-day RSI is even lower at 11, indicating that selling pressure is extremely high. Historically, such low RSI levels have been followed by a short-term rebound, but it’s far from guaranteed. If Bitcoin fails to hold near $80,000, it could trigger another wave of panic selling.

Altcoins Struggle to Stay Afloat

Ethereum is also feeling the pressure, losing 10% in just one day and 23% over the past week. It’s now hovering just above $2,100, a new yearly low that hasn’t been seen since 2023.

Other altcoins are struggling too. XRP is barely holding above $2, clinging to this important level by just one cent. Solana is in an even more challenging position, having lost almost half its value over the past month and dropping below $130.

Fear & Greed Index: Extreme Fear

The Fear & Greed Index, which measures market sentiment, is currently at 16, signaling extreme fear. Just yesterday, it was at 10, the lowest level since June 2022. This reflects growing panic among investors, leading to widespread selling as people rush to exit risky assets.

What’s Behind the Drop?

While Trump’s announcement of tariffs on Mexico, Canada, and the European Union triggered initial market panic, today’s drop is more mysterious. There hasn’t been a major news event to explain the scale of the crash. Some analysts suggest that the market is still reacting to a series of negative headlines from the past few weeks, including the tariffs, celebrity-endorsed memecoin rug pulls and the massive Bybit hack. These incidents have shaken investor confidence, leading to panic selling. We summarized all those events here.

The situation is further complicated by the global economic environment. Stock markets are also bleeding, with major indexes in the U.S. and Europe experiencing sharp declines. The broader Fear & Greed Index for the entire market – not just crypto – also stands at extreme fear. This suggests that investors are moving away from risky assets in general, not just cryptocurrencies.

Emotional Trading

It’s crucial for investors to avoid making decisions based on emotion. The current market panic is largely driven by fear, as evidenced by the low Fear & Greed Index. Panic selling can lead to even bigger losses, especially if investors are dumping their holdings at a loss.

If you invested in cryptocurrencies because you believe in the underlying technology, regulatory changes, or upcoming ETF introductions, remember that those reasons haven’t changed. They may be delayed, but they haven’t disappeared. This is a tough market, but history shows that those who stay calm and hold onto their investments often come out stronger on the other side.

If you’re feeling overwhelmed by the current volatility, take a moment to reassess your investment strategy. Are you in it for short-term gains, or do you believe in the long-term vision of blockchain technology? How much volatility can you handle both financially and emotionally? Your answers should guide your next steps.