BlackRock CEO Larry Fink has issued one of his most serious warnings yet, and it comes with an unsettling forecast. In his annual letter to investors, dated Monday, Fink expressed deep concern that the U.S. dollar may lose its role as the world’s reserve currency – and that Bitcoin could be next in line to take its place.

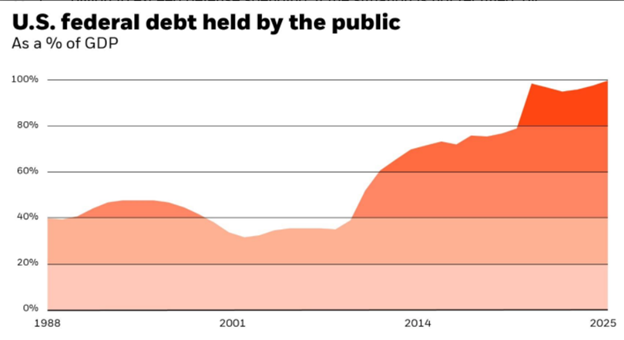

The message isn’t subtle. Fink pointed to the United States’ swelling national debt and exploding interest payments as a fundamental threat to its long-held monetary dominance. Since the famous Times Square debt clock began counting in 1989, the debt has grown at three times the pace of the nation’s GDP, he wrote.

According to Fink, 2024 is no exception, and the U.S. government will pay more than $952 billion in interest this year alone – an amount that surpasses even the country’s defense budget. If the pattern continues unchecked, mandatory spending and interest payments will eat up the entirety of federal revenue by 2030, potentially locking the U.S. into a never-ending budget shortfall.

Bitcoin vs. Dollar: Is the U.S. Dollar Losing Its Grip?

Fink’s concern is simple: investors could start seeing Bitcoin as a safer store of value than the dollar itself. Fink’s statement didn’t shy away from the growing appeal of digital assets. He acknowledged:

“I’m obviously not anti-digital assets (far from it; see the next section). But two things can be true at the same time: Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent.”

He highlighted the role of BlackRock’s own efforts in this shift. The company’s U.S. spot Bitcoin exchange-traded fund, known as IBIT, has become the largest ETF launch in financial history. In under a year, it raked in over $50 billion in assets under management. During 2024 alone, IBIT brought in $37.4 billion in net inflows, with total inflows exceeding $40 billion since its inception.

To put that into perspective, Fidelity’s competing fund, FBTC, gathered $11.5 billion – a fraction of what IBIT achieved. Fink noted that IBIT is now the third-largest fund by asset gathering across the entire ETF industry, trailing only major S&P 500 index funds.

Tokenization Isn’t Just a Trend – It’s the Future

Fink’s focus wasn’t limited to Bitcoin. He pointed toward something with even broader implications: tokenization. In simple terms, it’s the process of turning real-world assets like real estate, stocks, or bonds into digital tokens that can be traded online.

According to Fink, this development could fundamentally change how investing works. In his words, “Every stock, every bond, every fund – every asset – can be tokenized”. This would allow for instant transactions, 24/7 markets, and the elimination of the lengthy settlement delays that tie up billions in capital. He compared the shift to going from mail to email – a leap, not a step.

More than just speed, tokenization also opens doors. With fractional ownership and better access to high-yield investments, more people can participate in markets that were once reserved for the rich.

“Tokenization is democratization.”

Fink came back to his central theme with a sharper edge. He warned that unless the U.S. reins in its runaway deficits, it will forfeit its global monetary leadership.

“If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like bitcoin.”

BlackRock’s own direction is clear. The company is putting real money into blockchain development, data analytics, and infrastructure. These investments aren’t experimental – they are part of a deliberate pivot toward reshaping how finance works in the future.

Read also: How Interest Rates Impact Bitcoin: Exploring the Correlation