The cryptocurrency market has shown an impressive upswing recently, with a meaningful increase in both market cap and trading volume. This suggests renewed enthusiasm among investors. Over the past week, the entire market capitalization has risen by over 5%, a reflection of the increased interest and confidence in cryptocurrencies. What stands out even more is the trading volume, which has more than doubled in the last month. Such a surge may indicate heightened investor activity and a possible shift away from mere speculative trading to more substantial investment behavior.

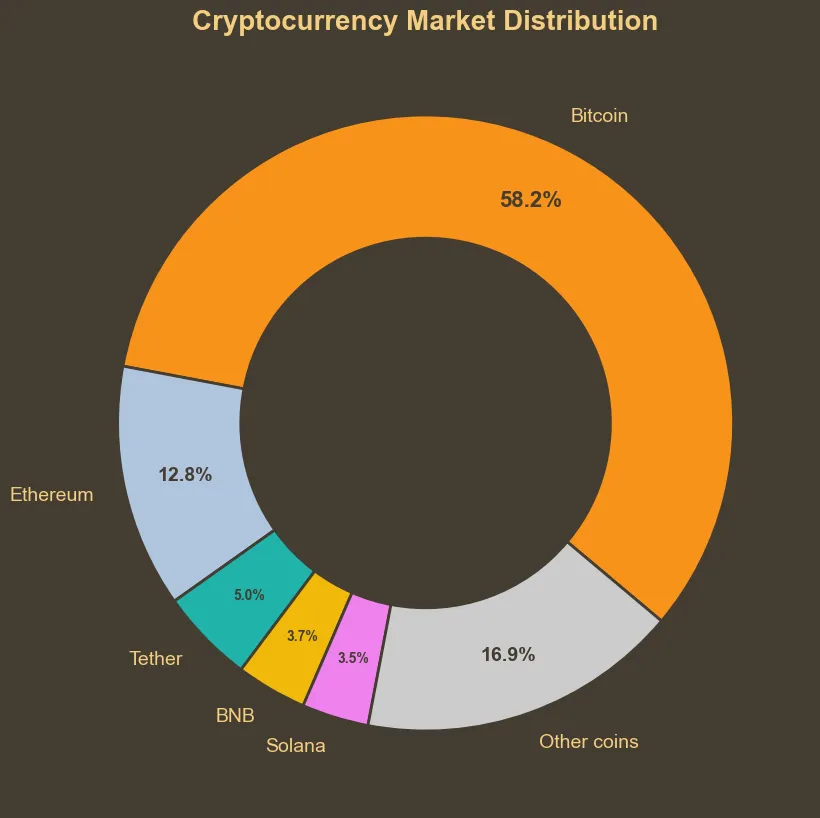

Bitcoin continues to dominate the market, holding a strong position above 58% dominance. Recently trading above $71,000, it nudges close to its all-time high, pulling other major cryptocurrencies into the green as well. Bitcoin’s leading role in the market means that its movements often set the tone for altcoins. This correlation can be appealing as it suggests shared momentum across the crypto landscape. Ethereum, Solana, and BNB, all part of the top tier of cryptocurrencies, have leveraged Bitcoin’s performance to show similar gains. Such movement demonstrates a widespread positive sentiment that is not exclusive to Bitcoin enthusiasts, enveloping the broader crypto community.

Memecoins On Their Own Run

One of the more surprising stories over the last few days in the crypto world is the surge of Dogecoin. Notching a notable 15% rise last day, its rally can be attributed to the buzz surrounding the upcoming presidential elections. This buzz was sparked by the discussions about a potential creation of the Department of Government Efficiency, acronymically dubbed D.O.G.E., backed by Elon Musk. While the direct connection between Dogecoin and the proposed department remains questionable, the hype has nevertheless been infectious. This has driven interest not just in Dogecoin but across a broad range of memecoins, all seeing positive momentum.

While the market sentiment appears strong, as evidenced by a steady “greed” level in the fear and greed index, we cannot forget about possible volatility. The crypto market is susceptible to shifts spurred by macroeconomic events, regulatory developments, interest rate decisions, and most importantly presidential elections.