South Korea’s central bank has made its stance clear – Bitcoin will not be included in its foreign exchange reserves, according to a report by Korea Herald. The Bank of Korea (BoK) considers the cryptocurrency too volatile, posing risks to national financial stability. Despite Bitcoin’s recent highs in January, when it almost reached $110,000, the central bank refuses to treat it as a reserve asset.

Table of Contents

Why Rejection?

The BoK believes cryptocurrencies fail to meet the International Monetary Fund’s (IMF) criteria for reserve assets. According to the IMF, such assets must maintain liquidity, market value, and credit stability. Bitcoin’s volatile nature makes it an unreliable store of value. As of now, South Korea has not even begun reviewing Bitcoin as a potential reserve currency.

In the case of cryptocurrency market instability, the transaction costs to cash out Bitcoins could rise drastically

The country remains focused on developing crypto regulations for businesses rather than considering it for its treasury. South Korea’s Financial Services Commission (FSC) is set to finalize corporate crypto participation guidelines by April 2025.

Which Countries Have Rejected Bitcoin Reserves So Far?

South Korea is not alone in its refusal to hold Bitcoin, other countries are also rejecting the idea of a strategic Bitcoin reserve. On March 1, 2025, Swiss National Bank (SNB) President Martin Schlegel rejected a proposal to allocate part of Switzerland’s reserves to Bitcoin. He argued that cryptocurrencies lack the fundamental qualities required for a reliable currency.

In January 2025, European Central Bank (ECB) President Christine Lagarde dismissed a proposal by Czech central banker Aleš Michl to include Bitcoin in the country’s official reserves. Lagarde underscored that Bitcoin does not align with the necessary attributes of reserve assets, such as liquidity, security, and stability, and asserted that Bitcoin has no place in European central banking.

Read also: Everything You Need to Know About the Digital Euro

Australia’s government has adopted a similar stance. The current administration has no plans to establish a national Bitcoin reserve, but political shifts could alter this position. A recent YouGov poll shows a close contest between the center-right coalition and the ruling center-left Labor government, with the opposition leading 51% to 49%.

Japan’s government recently reviewed a proposal by Senator Hamada Satoshi to hold Bitcoin in foreign reserves. While Hamada highlighted global interest in Bitcoin, officials emphasized that discussions are still preliminary. Citing Bitcoin’s volatility, Japan maintains its focus on stability, making it unlikely to adopt Bitcoin under current policies.

| Country | Rejecting Institution | Primary Reasons |

|---|---|---|

| European Union | Managing Director of European Stability Mechanism, ECB President | Concerns about monetary sovereignty, financial stability, risks to digital euro project, volatility. |

| South Korea | Bank of Korea (BOK) | High price volatility, non-compliance with IMF criteria for foreign exchange reserves, high transaction costs, speculative nature, and lack of intrinsic value. |

| Switzerland | Swiss National Bank (SNB), SNB President Martin Schlegel | Volatility, relatively small market capitalization, Bitcoin is software, security weaknesses, lack of essential characteristics of a good currency. |

| Japan | Japanese Government Officials | Bitcoin’s volatility does not align with Japan’s foreign reserve management framework, which prioritizes safety and stability. Discussions are still in the early stages. |

Trump’s Bitcoin Reserve Plan Faces Skepticism

Despite rejections from several major economies, the United States, under President Trump, has moved in the opposite direction. On March 6, 2025, Trump signed an executive order to establish a Strategic Bitcoin Reserve, utilizing seized Bitcoin from criminal and civil cases. The initiative includes not just Bitcoin but also Ethereum, XRP, Solana, and Cardano.

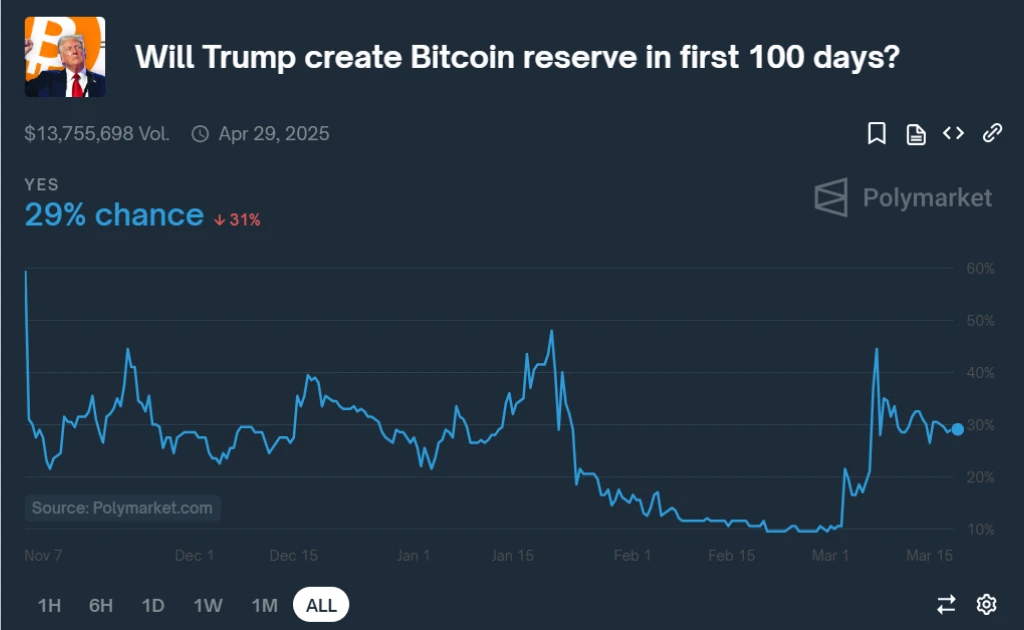

However, market sentiment around Trump’s plan remains uncertain. Data from Polymarket suggests only a 29% probability that Trump will successfully implement the Bitcoin reserve before April 29. Many financial experts remain skeptical about whether this policy will gain traction or face opposition within the U.S. regulatory system.

Read also: Poland Rejects Bitcoin Reserves, But Is the Idea Completely Dead?