Ethereum has seen another sharp decline in price, falling to levels not seen since 2023. After briefly surging above $2,500 following the U.S. government’s crypto reserve announcement, ETH erased all its gains and now struggles to hold $2,100. Investors remain cautious as trade war fears and institutional outflows weigh heavily on sentiment.

Table of Contents

Momentum Indicators

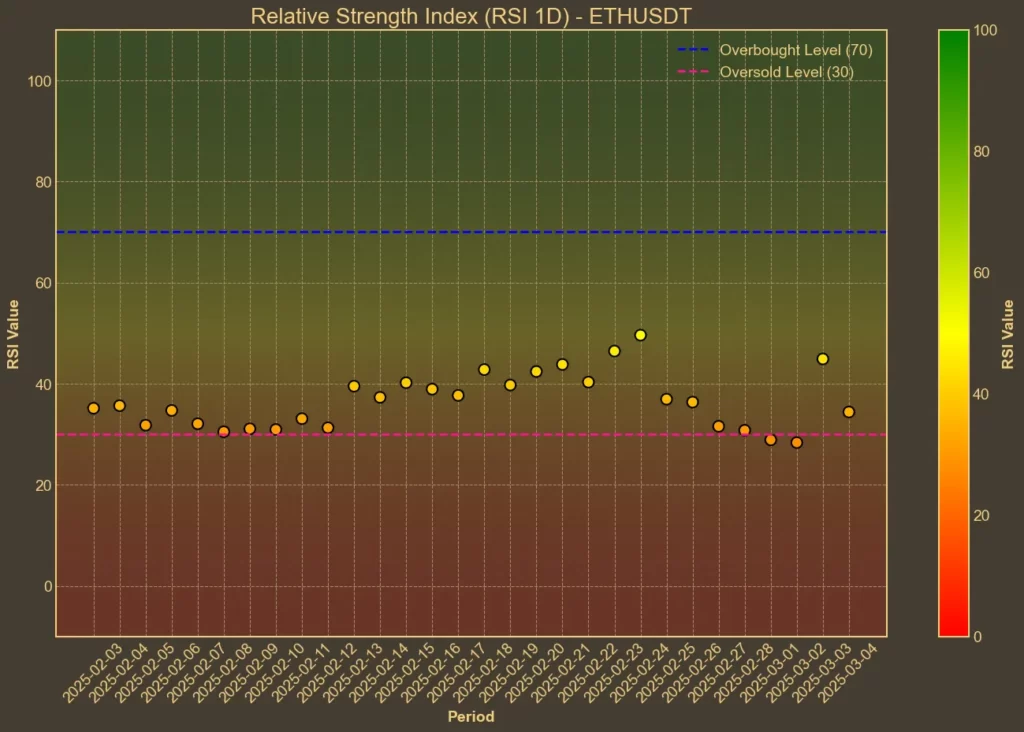

RSI: Oversold

The Relative Strength Index (RSI) indicates whether Ethereum is overbought or oversold. Currently standing at 33 on the 14-day RSI, down from 34 yesterday, it suggests that ETH may be experiencing selling pressure. The short-term 7-day RSI has also decreased to 30, reinforcing the oversold condition.

MFI: Weak

The Money Flow Index (MFI), which factors in volume, is at 33 for the 14-day period, slightly up from 32 yesterday but significantly lower than the 44 a week ago. This decline points to weakening buying momentum and reduced investor interest.

Fear & Greed Index: Extreme Fear

The Fear & Greed Index for the broader crypto market has dropped to 15 today, down from 33 yesterday. This extreme fear suggests that investors are highly cautious, potentially anticipating further declines in crypto prices.

Moving Averages

SMA & EMA: Bearish

Ethereum’s 9-day SMA is at 2,316, with the 9-day EMA slightly higher at 2,320. Longer-term indicators, such as the 26-day SMA at 2,562 and the EMA at 2,557, confirm that ETH remains below key resistance levels. The downward slope suggests continued bearish momentum, and ETH will need to break above short-term moving averages before any recovery can begin.

Bollinger Bands: Increased Volatility

Ethereum is trading near the lower Bollinger Band at 2,082, while the upper band is much higher at 2,990. This suggests ETH is oversold and due for a potential bounce, but the wide bands indicate high volatility, making any recovery uncertain.

Trend & Volatility Indicators

ADX: Strong Downtrend

The ADX(14) is at 41, signaling a strong trend. Since the price has been falling, this confirms that the current bearish trend has significant momentum.

ATR: High Volatility

The ATR(14) is 213, slightly lower than yesterday’s 217 but still much higher than the 185 recorded a week ago. This suggests that ETH is experiencing strong price swings, making it a riskier trade in the short term.

AO: Bearish

The Awesome Oscillator (AO) is at -420, lower than yesterday’s -406 and far below last week’s -184. The deep negative value confirms bearish momentum, suggesting sellers remain in control.

VWAP: Bearish

ETH’s VWAP today is 3,140, significantly above the current market price. This indicates that Ethereum is trading below the average price weighted by volume, reinforcing the downward pressure.

Relative Performance

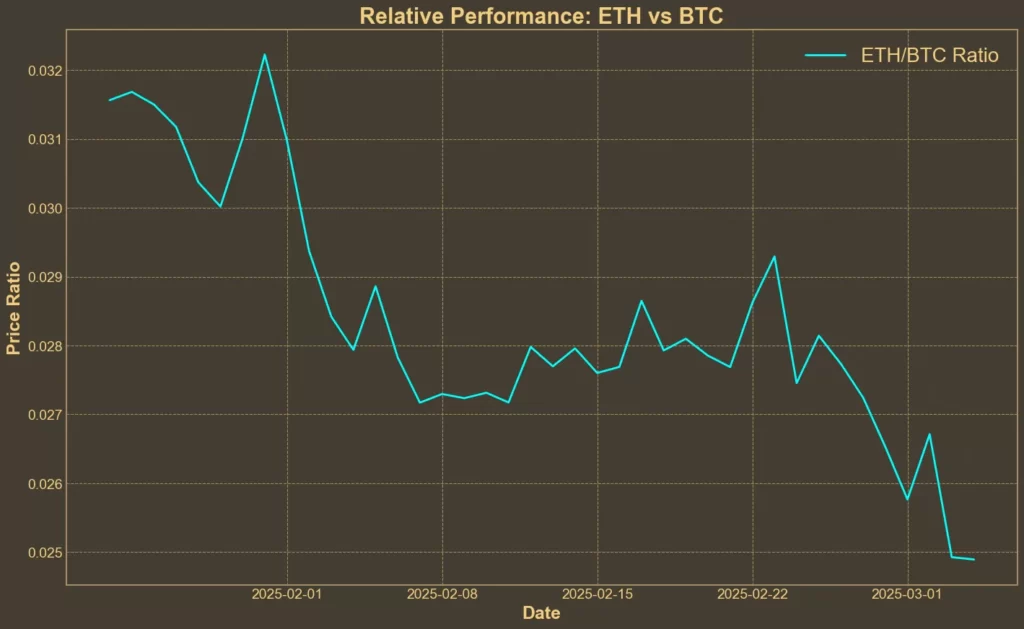

Comparison Against BTC: Lowest Since 2020

Ethereum has been underperforming Bitcoin, with the ETH/BTC ratio dropping by 11% in the last week and 12% over the past month. The ratio now stands at 0.025, its lowest level since 2020. This might suggest that investors are shifting funds from Ethereum into Bitcoin, further weakening ETH’s market position.

Will Ethereum Recover?

Oversold conditions on RSI and Bollinger Bands suggest that a short-term bounce is possible, but the broader trend remains overwhelmingly bearish. Institutional investors have been pulling funds out of Ethereum ETFs, while macroeconomic uncertainty and escalating trade war continues to put pressure.

Ethereum could regain some ground if its Pectra upgrade successfully improves network efficiency and scalability. However, for now, the technical indicators tell a clear story: Ethereum remains one of the weakest major assets in the crypto market, and any recovery will require a major shift in sentiment.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!