The memecoin Book of Meme (BOME) has recently grabbed the attention of investors due to its spectacular price surge. Over the past week, the coin’s value has skyrocketed by over 40%, and today’s gain of 24% keeps that momentum going. If this growth continues, BOME could soon break into the top 100 largest cryptocurrencies.

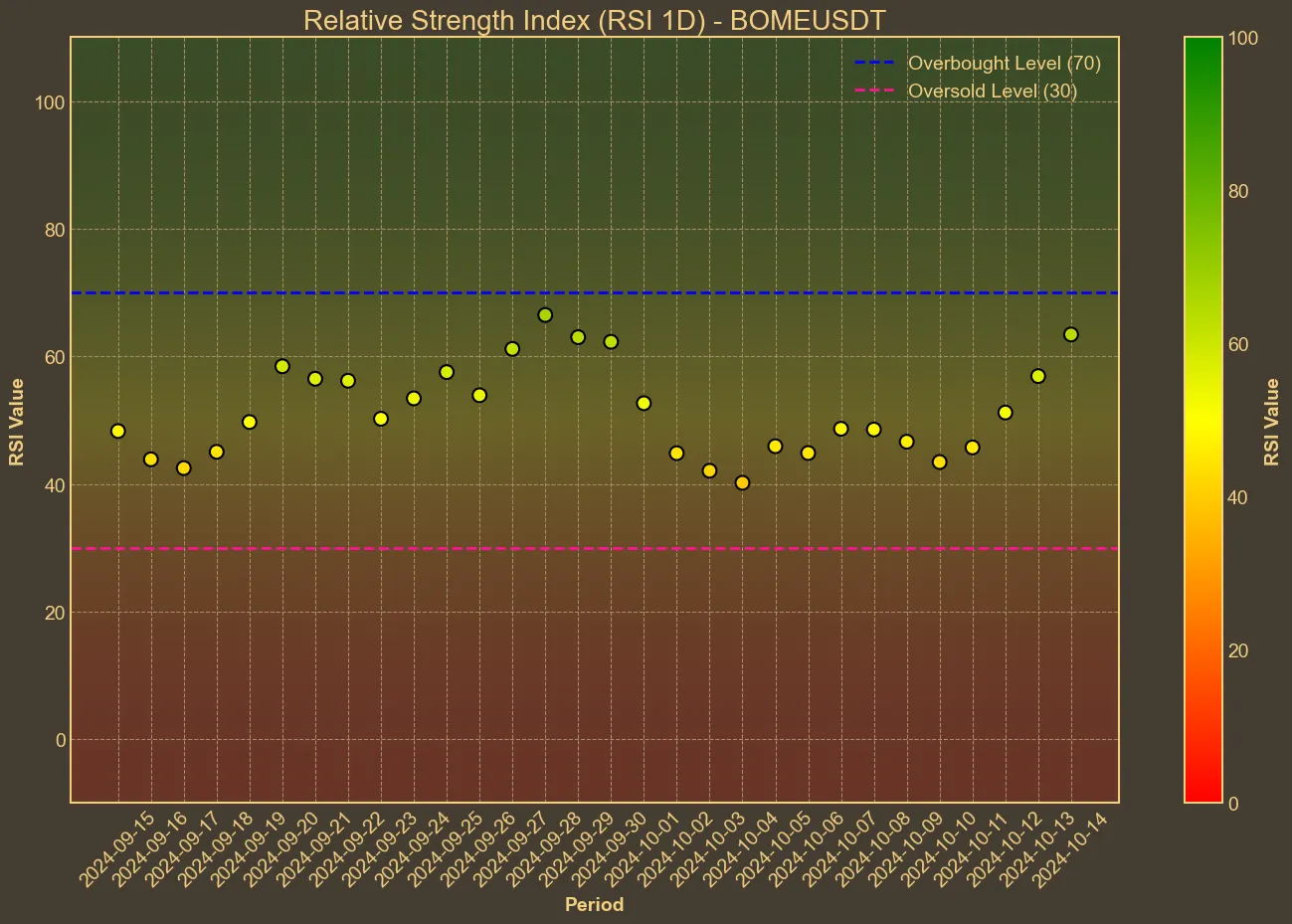

Technical analysis provides a lens to examine this trend more closely. One key indicator, the Relative Strength Index (RSI), is currently sitting at 74. This suggests that Book of Meme might be overbought. Just a week ago, the RSI was at a more neutral level of 49, indicating rapid market momentum.

The Simple Moving Average and the Exponential Moving Average both reflect a positive change, aligning with the ongoing price advancement. The Moving Average Convergence Divergence (MACD) also shows a positive trend, reinforcing the bullish signals.

Market capitalization is another area reflecting substantial growth, with an increase of over 37% in just a week. Volume shifts are even more compelling, experiencing an unprecedented jump of almost 273% in the same time frame. Such volume increases can signal renewed interest and participation, possibly driven by new developments or speculative trading behaviors. However, it is crucial to recognize that these indicators, while helpful, are not foolproof. Market trends can be deceiving, and sudden shifts might leave investors vulnerable.

While these technical indicators point toward bullish trends, they come with caution. The current RSI suggests BOME could be overbought, which might lead to a price correction soon. It’s important to remember that technical analysis, while a valuable tool, has its limitations. It doesn’t account for external factors such as today’s positive news from China or the unpredictable memecoin hype.

Investors should approach this opportunity carefully, balancing the excitement of potential gains with the possibility of sudden market shifts.