Dogecoins recent price action has been anything but stable. After experiencing a 32% drop in the last month, Dogecoin is currently priced near $0.17 – still up 20% from a year ago but far below the $0.47 peak seen in December. Despite the market’s uncertainty, some indicators suggest that a shift in momentum may be forming.

Table of Contents

Momentum Indicators

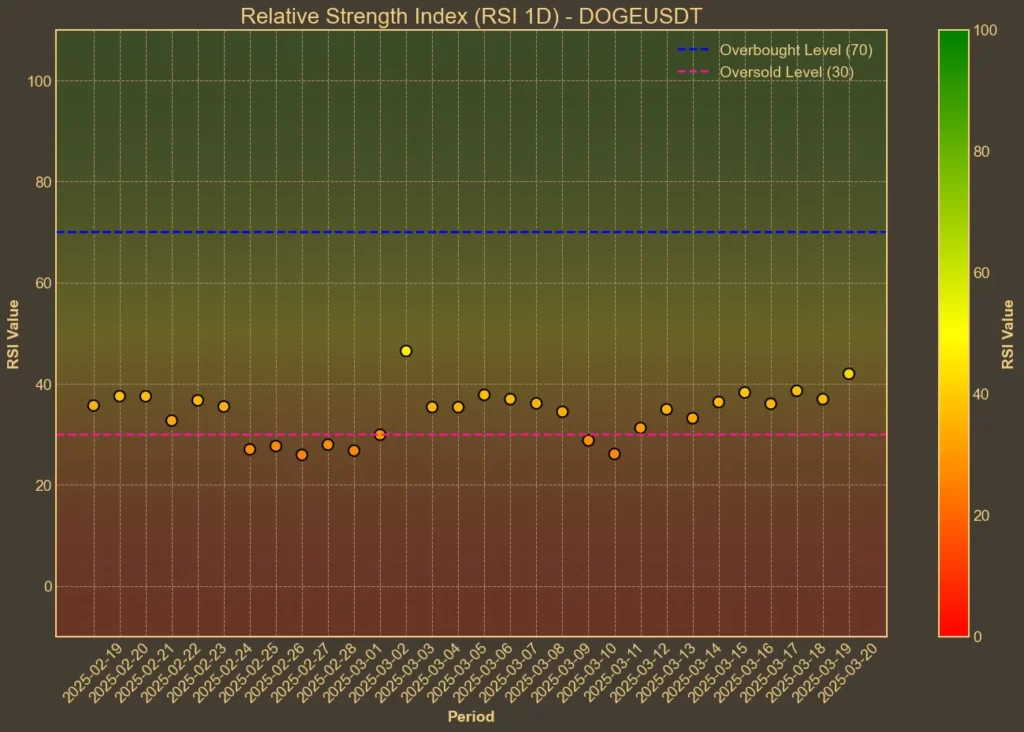

RSI: Neutral

The Relative Strength Index (RSI) measures whether an asset is overbought or oversold. Today, RSI(14) stands at 39, lower than yesterday’s 42 but higher than the 33 recorded a week ago. The shorter-term RSI(7) is 42, down from 50 yesterday. While not yet in oversold territory, RSI signals weakening momentum, suggesting that Dogecoin could be approaching a key level for buyers.

MFI: Overbought

The Money Flow Index (MFI) accounts for both price and volume to assess buying pressure. MFI(14) is currently at 27, a steep drop from 35 yesterday and 34 a week ago. This indicates that selling pressure has intensified, which could weigh on price action in the near term.

Fear & Greed Index: Neutral

The Fear & Greed Index, which reflects overall crypto market sentiment, has improved in recent days. It currently sits at 49, compared to 32 yesterday and 45 a week ago. While this shift suggests fading fear, Dogecoin’s price has yet to reflect stronger bullish conviction.

Moving Averages

SMA & EMA: Bearish

The Simple and Exponential Moving Averages provide insight into Dogecoin’s price trend.

- SMA(9): 0.1713

- EMA(9): 0.1732

- SMA(26): 0.1903

- EMA(26): 0.1934

Dogecoin’s short-term averages are below its longer-term ones, confirming that the coin remains in a downtrend for now. To shift momentum, Dogecoin would need to reclaim levels above $0.19.

Bollinger Bands: Increased Volatility

Bollinger Bands measure market volatility and potential breakout points. Currently, the upper band is 0.224, while the lower band is 0.143. With Dogecoin hovering closer to the lower band, there’s potential for a rebound if demand increases. However, if selling persists, it could push DOGE toward the lower support range.

Trend & Volatility Indicators

ADX: Moderate Trend

The Average Directional Index (ADX) indicates the strength of a trend. ADX(14) is currently at 39, unchanged from yesterday and only slightly lower than the 40 from a week ago. This suggests that Dogecoin’s downward trend remains intact but is not necessarily strengthening.

ATR: Decreasing Volatility

The Average True Range (ATR) measures volatility. ATR(14) has dropped to 0.0168, down from 0.0171 yesterday and 0.021 a week ago. A decrease in ATR suggests that price fluctuations are becoming less extreme, which could indicate stabilization.

AO: Bearish

The Awesome Oscillator (AO) helps confirm trend momentum. AO stands at -0.0348, slightly improving from -0.0375 yesterday but still in negative territory compared to -0.0567 a week ago. While bearish, the smaller negative values suggest that selling momentum may be slowing.

VWAP: Below Average

The Volume Weighted Average Price (VWAP) is a key indicator for institutional traders. VWAP today is 0.3036, well above the current price, indicating that Dogecoin is trading below its volume-weighted average and could be considered undervalued.

Relative Performance

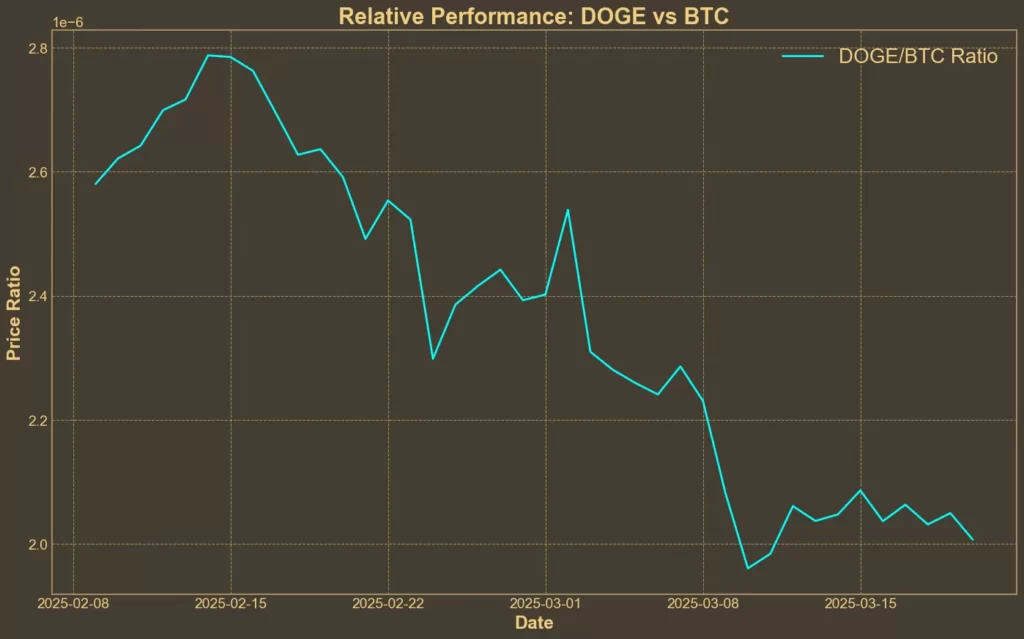

Comparison Against BTC: Weak

Dogecoin has underperformed compared to Bitcoin over multiple time frames. The DOGE/BTC shows 1.5% decline in the past week and a 24% drop over the last month. While Dogecoin’s trend against Bitcoin appears stable in the short term, its longer-term trajectory suggests continued weakness.

Market Sentiment & News

While technical indicators are mixed, on-chain data points to some encouraging signs. The number of large Dogecoin holders, known as sharks and whales, has been increasing, suggesting potential accumulation despite weak price action. Additionally, reports indicate that Dogecoin wallet holdings are rising, which historically has preceded reversals.

However, outside of speculative factors, Dogecoin remains highly correlated to overall market trends, and broader risk sentiment will likely dictate its next moves.

Conclusion

Dogecoin’s technical indicators reflect an uncertain outlook. Momentum indicators, such as RSI and MFI, suggest that bearish pressure is still present, while moving averages confirm the ongoing downtrend. However, the Fear & Greed Index, Bollinger Bands, and AO indicate a potential stabilization or even a short-term reversal if buyers step in.

The key resistance level to watch is $0.19, while support remains near $0.143. If Dogecoin can reclaim its short-term moving averages, it could regain positive momentum, but if selling continues, further downside remains possible.

As always, technical analysis is limited and does not account for unexpected events or fundamental changes. While indicators provide a snapshot of market conditions, external factors like regulations, macroeconomic shifts, or sudden social media-driven interest can override patterns.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!