Dogecoin is once again making headlines, but this time, it’s not about price movements or Elon Musk’s endorsements. The main topic is a potential Dogecoin exchange-traded fund (ETF). Bitwise Asset Management has submitted a Spot Dogecoin ETF proposal to the U.S. Securities and Exchange Commission (SEC), signaling a major shift in how the market perceives the biggest memecoin.

With growing speculation that Litecoin could soon secure ETF approval, does Dogecoin have a real shot at following suit?

Table of Contents

The Case for a Dogecoin ETF

The idea of a Dogecoin ETF might seem unlikely at first. After all, Dogecoin started as a joke and has long been considered a speculative asset rather than a serious investment. However, the landscape has changed. With growing institutional interest and increased regulatory clarity, DOGE is no longer just an internet meme – it’s a crypto asset with a substantial market cap and real adoption.

Currently, Polymarket places the odds of a Dogecoin ETF approval at 56%, a notable increase from earlier predictions. This shift reflects greater confidence in Dogecoin’s legitimacy, largely driven by its status as one of the longest-standing cryptocurrencies and its widespread recognition.

Litecoin’s ETF Approval Might Be a Key

A strong case for a Dogecoin ETF lies in its connection to Litecoin. Litecoin (LTC) was originally forked from Bitcoin, and Dogecoin was later derived from Litecoin. Many believe that since Bitcoin was deemed suitable for an ETF and Litecoin is now a strong candidate, DOGE could logically follow.

The probability of a Litecoin ETF being approved in 2025 has surged to 85% on Polymarket, reflecting optimism among investors. With potential regulatory shifts under Donald Trump’s administration, the acceptance of new ETFs seems increasingly likely. If Litecoin does secure approval, it could set a precedent that strengthens the case for Dogecoin.

What Would a DOGE ETF Mean for Investors?

An approved Dogecoin ETF would open the doors for mainstream investors who prefer traditional financial instruments over direct crypto holdings. This could increase demand and drive up DOGE’s price, much like Bitcoin ETFs did for BTC.

Additionally, ETFs provide a regulated way to gain exposure to crypto assets, which could attract institutional capital that has so far hesitated to enter the Dogecoin market due to its volatility and lack of structured investment vehicles.

Challenges and Roadblocks

Despite the rising optimism, challenges remain. Dogecoin lacks the institutional support and network security of Bitcoin or Ethereum, which have already seen ETF approvals. The SEC has also been cautious about approving crypto-based ETFs beyond Bitcoin, meaning DOGE might still face regulatory skepticism.

Moreover, its inflationary model – where new Dogecoins are continuously added to the supply – could be a sticking point for regulators who prioritize scarcity and store-of-value potential in ETF decisions.

Current DOGE Price

Despite the positive ETF developments, Dogecoin’s price has struggled in recent weeks. Over the last seven days, DOGE has declined by more than 10%, though it remains up 2% for the past month.

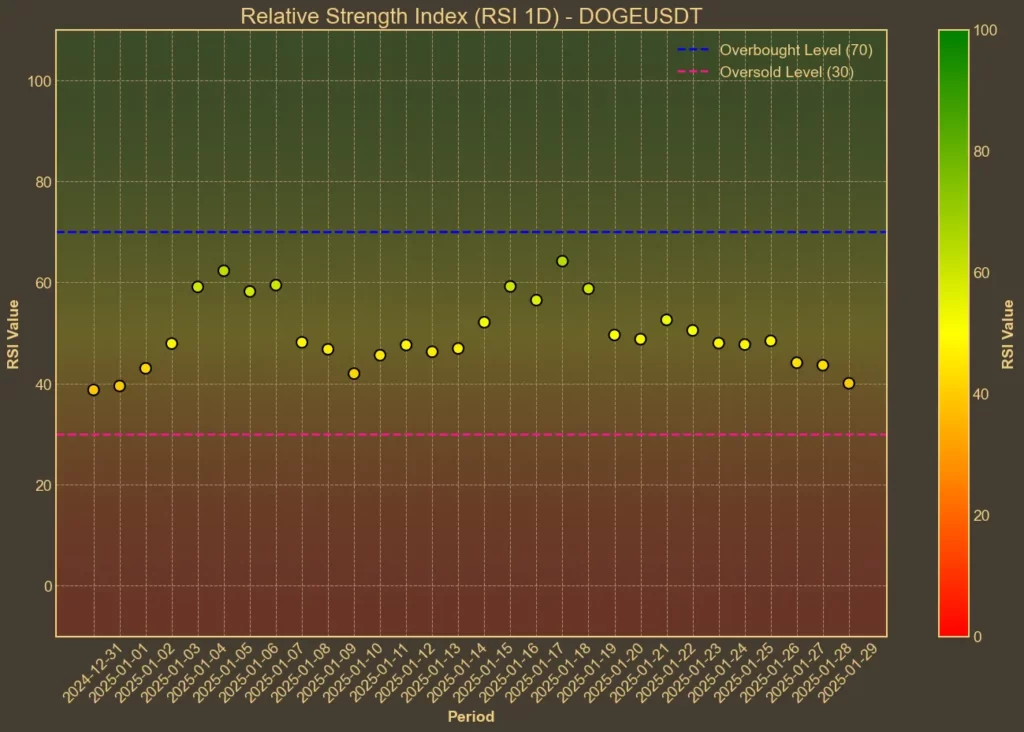

The Relative Strength Index (RSI) is hovering around 43, suggesting that the cryptocurrency is neither overbought nor oversold at the moment. This neutral RSI indicates potential stability, but also leaves room for future volatility based on market sentiment and external factors.

Final Thoughts

The possibility of a Dogecoin ETF is no longer just speculation – it’s now a real conversation among regulators and asset managers. If Litecoin’s ETF gains approval, it would set a major precedent that could further strengthen the case for Dogecoin.

If DOGE does secure an ETF, it would mark a new era for the cryptocurrency, proving that even the most unconventional assets can achieve mainstream acceptance.