Dogecoin is in a challenging moment, losing nearly 10% today and slipping below the critical $0.35 support level. This drop comes just two days after it hovered close to $0.40. Other memecoins are also struggling, with SHIB down almost 19% this week, while PEPE, BONK, WIF, and FLOKI have plunged by more than 20%. The sole exception is Pudgy Penguins (PENGU), which remains buoyed by hype – though even this coin dropped 8% today.

Struggling to Maintain Support

Over the past week, Dogecoin has experienced a notable decline, with its price dropping by over 16%. This downward trajectory has been driven by various factors, including recent regulatory developments and statements by Jerome Powell that have dampened market sentiment.

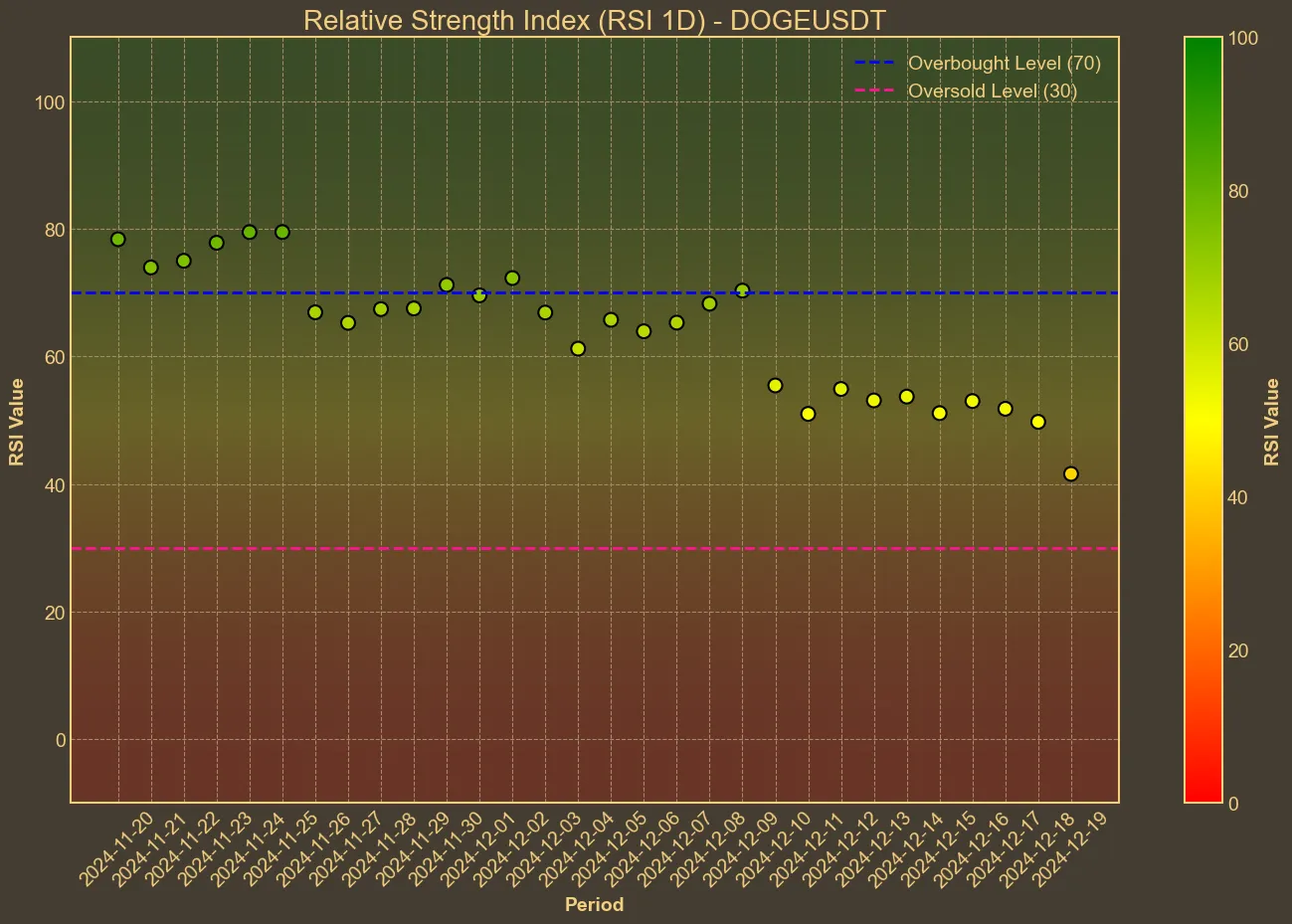

Despite these challenges, Dogecoin has shown some resilience. At the moment of writing this article the price came back to $0.35, indicating that the support level is holding for now. However, the Relative Strength Index (RSI) has been declining, moving below the neutral 50 mark. This decline suggests that bearish momentum is strengthening, making it essential for Dogecoin to maintain its current support to avoid further losses.

Technical Indicators Signal Caution

Analyzing Dogecoin’s technical indicators reveals a complex picture. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) have both been on a slight downward trend, reflecting the recent price declines. Additionally, the Moving Average Convergence Divergence (MACD) remains below its signal line, reinforcing the bearish outlook.

Volume trends add another layer of complexity. While there has been an increase in trading volume over the past few days, indicating heightened interest, the overall market cap has been decreasing. This divergence suggests that while more trades are occurring, they may not be strong enough to reverse the current downward trend.

Moreover, the Average True Range (ATR) indicates widening volatility, which could result in more significant price swings. Traders should be cautious, as increased volatility often precedes substantial market movements, either upward or downward.

Market Sentiment and External Influences

Dogecoin’s performance has been heavily impacted by external factors. The Federal Reserve’s hawkish stance on monetary policy has triggered a broader cryptocurrency market downturn, affecting both major coins and altcoins like Dogecoin. Powell’s comments about the FED having no intention of holding Bitcoin reserves further dampened investor confidence.

Dogecoin’s is also influenced by association with prominent figures. However it’s important to understand that while endorsements from influential personalities like Elon Musk can provide temporary boosts, the underlying technical indicators suggest that sustained support is necessary for long-term growth.

Path Forward: Potential for Recovery

Despite the current bearish trends, there are signs that Dogecoin could stabilize and potentially recover. If Dogecoin manages to hold above the $0.35 support level, it may pave the way for an upward movement. Technical analysts point out that maintaining this support could lead to a rebound back towards $0.41, signaling renewed investor confidence and likely boosting other memecoins as well.

However, the RSI remains a concern. For a true recovery to gain momentum, the RSI needs to move back above 50, indicating that buying pressure is overcoming selling pressure. Without this shift, the risk of further declines remains significant, potentially pushing Dogecoin towards the next $0.31 support level.

Cautionary Notes on Technical Analysis

While technical analysis provides valuable insights into market trends, it’s important to recognize its limitations. Market conditions can change rapidly due to unforeseen events, and technical indicators may not always predict future movements accuratel – as we’ve seen yesterday.

The ability to maintain key support levels will play a crucial role for DOGE in determining its short-term trajectory. While there is potential for recovery, the current technical indicators suggest that caution is warranted.