The launch of the Libra memecoin was supposed to be a moment of excitement, but it quickly turned into one of the biggest financial disasters in recent crypto history. A single tweet from Argentina’s president, Javier Milei, fueled a $4.5 billion surge – only for the coin to collapse within hours.

Table of Contents

A Presidential Endorsement Gone Wrong

On February 14, 2025, Javier Milei posted a (now deleted) message on social media promoting the Libra memecoin. His endorsement instantly sparked a buying frenzy, pushing the token’s market cap to $4.5 billion in just a few hours. The coin was marketed as a private initiative aimed at supporting Argentina’s economy, funding small businesses, and encouraging investment in local startups.

However, within hours of reaching its peak, the price of Libra nosedived by over 90 percent. Investors were left scrambling for answers as insiders started cashing out millions, leaving retail traders with massive losses.

The $107 Million Cash-Out

Blockchain analysis later revealed that insiders had withdrawn approximately $107 million from the project’s liquidity pools. Eight wallets linked to the development team pocketed $57.6 million in USDC and nearly $50 million in Solana (SOL), triggering what appeared to be a textbook pump-and-dump scheme.

One particularly suspicious detail was that the wallet responsible for deploying the Libra contract had received funds from an exchange that does not require KYC (Know Your Customer) verification. This raised immediate red flags about whether the token was ever a legitimate project in the first place.

Milei’s U-Turn and Furious Response

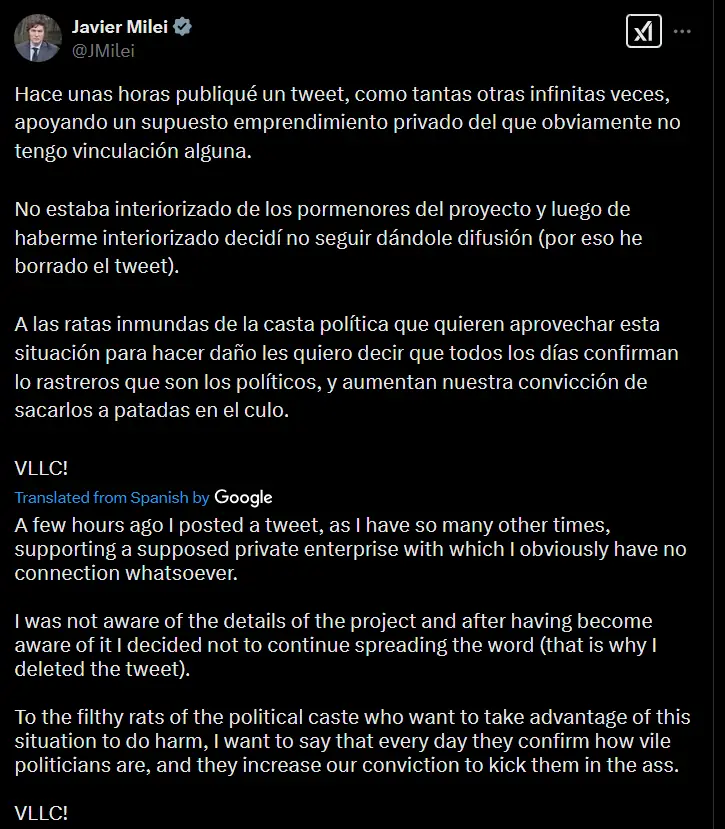

As criticism mounted, Milei quickly distanced himself from the project, deleting his original endorsement and issuing a statement claiming he had been unaware of the full details of the coin.

He lashed out at his political opponents, accusing them of trying to use the scandal to undermine him. In his statement, he wrote, “To the filthy rats of the political caste who want to take advantage of this situation to do harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the ass.”

Despite his denial, the damage was already done. The token’s price collapsed, wiping out billions in market value, and retail investors were left holding worthless coins.

Update 16.02.2025

The fallout from the Libra scandal has reached Argentina’s political arena. Opposition lawmaker Leandro Santoro called for President Milei’s impeachment, stating, ‘This scandal, which embarrasses us on an international scale, requires us to launch an impeachment request against the president’.

Memecoins and Political Figures: A Dangerous Combination

The Libra debacle isn’t the first time a political figure has been linked to a memecoin, and it likely won’t be the last. Over the past year, we have seen other projects like TRUMP, MELANIA and the Central African Republic’s CAR token, which also saw wild price swings based on political hype.

Memecoin traders are often not interested in decentralized finance or blockchain technology – they’re just chasing hype. But it’s important to remember that riding a celebrity-endorsed wave can be a double-edged sword, especially considering Kanye West’s shocking revelation a few days ago.

The Bigger Picture: A Crypto Wake-Up Call?

The Libra disaster has reignited concerns about regulatory oversight in the cryptocurrency space. While memecoins have been a huge source of speculation and quick profits, they have also proven to be a high-risk investment that can collapse overnight.

For investors, the lesson is clear. Just because a public figure promotes a crypto project does not mean it is legitimate. Unverified projects, especially those tied to political figures, are often fueled by speculation rather than substance. If a coin’s price skyrockets too quickly, it might be a sign that insiders are preparing to dump their holdings.

Libra coin will likely go down as one of the biggest pump-and-dump schemes in recent history. The question now is whether investors will learn from this or fall for the next hype-fueled coin.

Update 18.02.2025

A few days later, there are new developments – Milei’s interview, an insider’s testimony, and research linking LIBRA to the MELANIA coin. We’ve summarized everything in this article.