Raydium has announced its own token launch platform, LaunchLab. This comes at a crucial time for Raydium, especially with recent revelations that Pump.fun is developing its own AMM to replace RAY.

Table of Contents

What Is Raydium’s New Token Platform?

LaunchLab is Raydium’s answer to the growing demand for an accessible, permissionless token issuance system within the Solana ecosystem. The platform introduces several innovative features designed to give developers more control over how their tokens enter the market.

Infra, a key contributor to Raydium, highlighted these capabilities in a post on X, stating that LaunchLab allows projects to customize their token pricing using various bonding curves – linear, exponential, and logarithmic. These models help adjust token valuations based on demand. At its core, LaunchLab is about making token creation easier while avoiding the constraints of existing launchpads.

Investors responded positively to the news, sending Raydium’s price up almost 20% in a single day. However, despite reentering the top 100 cryptocurrencies, it still remains down over 50% from its levels just a month ago.

What’s Behind LaunchLab Launch?

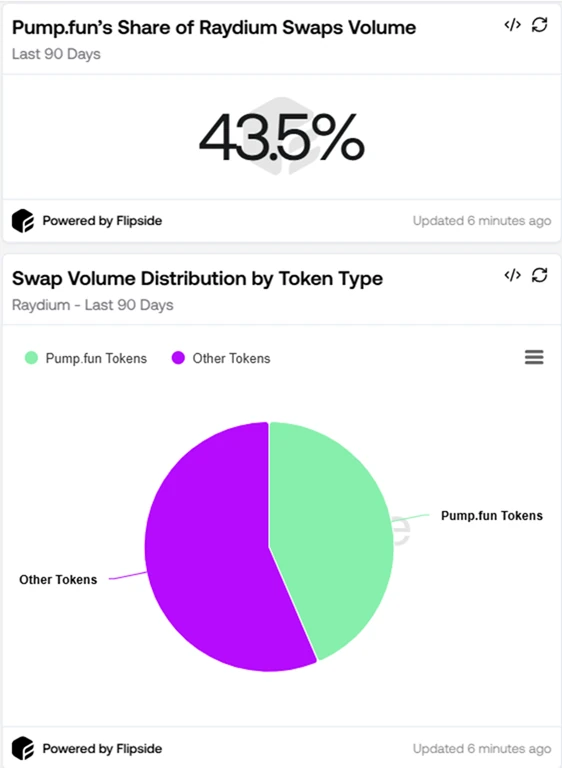

For Raydium, this initiative is about maintaining its relevance in the market. A shift was already underway as platforms like Pump.fun expanded their services beyond Raydium’s DEX infrastructure. Raydium’s trading activity has seen significant influence from Pump.fun, a platform responsible for 43.5% of Raydium’s total trading volume in the past 90 days.

Now, with Pump.fun building its own automated market maker (AMM), Raydium faced a potential revenue hit. In response, it has shifted its focus towards offering its token issuance platform, ensuring its continued significance in Solana’s memecoin ecosystem.

What Makes LaunchLab Stand Out?

Raydium’s LaunchLab isn’t just trying to be copy – it brings multiple standout features that set it apart from Pump.fun and other platforms:

- Flexible Pricing Models: The platform supports linear, exponential, and logarithmic bonding curves, allowing projects to set dynamic pricing based on demand.

- Third-Party Fee Structures: External interfaces can establish custom fee models, fostering a more diverse environment for investors and token creators.

- Seamless Liquidity Integration: Tokens launched through LaunchLab get direct access to Raydium’s liquidity pools, ensuring efficient trading and liquidity support.

These features enhance LaunchLab’s appeal, making it a valuable tool for projects looking to launch without technical barriers.

Final Thoughts

Raydium’s move to introduce LaunchLab is more than just a response to competition – it’s a strategic expansion into a growing market. While the battle between Raydium and Pump.fun will likely continue, LaunchLab gives developers a fresh option for launching tokens within the Solana ecosystem – and a new reason to have confidence in RAY.

Read also: What’s Happening with Pump.fun? A Look at Its Recent Activity Drop