Pump.fun, the Solana-based platform that played a major role in the memecoin frenzy, is now facing a steep decline. What’s going on, and is the controversial platform going to survive the current lack of interest?

Table of Contents

Number of Launched and Graduated Tokens Declines

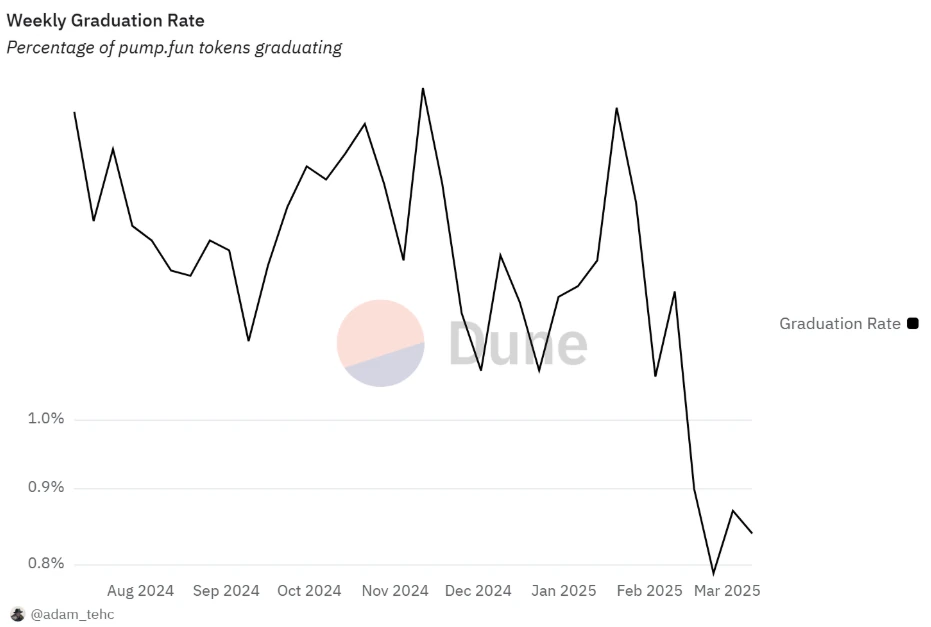

According to the latest data by Dune, from February to March 2025, the number of tokens successfully launching and completing their bonding curve plummeted – from 913 on February 1 to only 26 by March 14.

The “graduation rate”, showing how many tokens pass liquidity and trade rules to become fully tradable on decentralized exchanges, has been stuck under 1% for four straight weeks. Back in November 2024, Pump.fun had its best phase, hitting a peak of 1.67% graduation rate. Now, it’s struggling to push tokens past the starting phase.

Meanwhile, Solana’s weak price action is also in line with Pump.fun recent downfall. The token is now 54% down from its January peak of $294. The cryptocurrency also made a death cross in early March and is now on track for a further downtrend. The 20-day EMA remains a major resistance at $141.90, making further price declines a real possibility.

Scandals and Rug Pulls Tarnish Pump.fun’s Reputation

The recent controversies have been the major reasons for Pump.fun’s decline. A particularly damaging event was the shutdown of its livestream feature in November 2024, after users engaged in extreme and illegal activities – including violence and suicide threats – to promote their tokens. Following this, weekly revenue plunged by 66%, from $11 million to $6 million.

At the same time, Pump.fun has become notorious for its association with major and minor rug pulls. A rug pull happens when developers abandon a token after attracting investors, leaving them with worthless assets. One of the most shocking incidents involved a 13-year-old who launched the “Gen Z Quant” token through Pump.fun’s livestream feature. After driving up its value, he sold his holdings and abandoned the project, sparking outrage.

Scammers have also used a range of deceptive tactics, such as wash trading, volume bots, and cloning token contracts, to manipulate market activity. These strategies create the illusion of high trading volume, luring unsuspecting investors into buying worthless assets

MELANIA and LIBRA Rug Pulls Shake Investor Confidence

Two of the most high-profile rug pulls in recent weeks have been the MELANIA and LIBRA token crashes, which have severely damaged investor trust. LIBRA investors took a major hit when the token collapsed by 94% after insiders pulled millions from the liquidity pool.

Similarly, the MELANIA token – associated with U.S. First Lady Melania Trump – went through a pump-and-dump cycle before crashing. Further scrutiny showed that the same team was behind both schemes, raising serious concerns about ongoing fraud in the space.

With repeated scams plaguing the platform, traders are becoming more cautious. While memecoins are inherently risky, the scale of recent rug pulls has led many investors to rethink their approach. The question now is whether Pump.fun can recover or if the memecoin market will move on to other platforms.

Memecoins Are Cyclical, But Will Pump.fun Survive?

Despite Pump.fun’s struggles, memecoins are known for their boom-and-bust cycles. Even after major crashes – such as the 90% drop in activity following the LIBRA rug pull – memecoins have a tendency to make a comeback due to their seasonal popularity and strong communities, according to a recent report by CoinGecko.

However, if Pump.fun fails to regain user confidence, other platforms are ready to step in. Four.meme, a memecoin launchpad on the BNB Chain, is positioning itself as a safer and more stable alternative. Backed by the BNB Chain ecosystem, Four.meme offers greater transparency and has a 2025 roadmap focused on AI integration and faster transactions.

Are you investing in memecoins via crypto presales? We’ve got you covered. Our new Presale Index lets you look up presales you’re interested in and check for red flags before investing.