The cryptocurrency market has kicked off the week with a turbulent start, as Bitcoin suffered a sharp 5.7% decline in the past 24 hours. Currently trading near $99,000, Bitcoin’s sudden drop has pulled down several other significant cryptocurrencies, leaving traders on edge.

Table of Contents

Volatility Returns to the Market

Despite Bitcoin’s impressive 130% year-to-date gains and a robust 40% surge in the previous quarter, the past week has signaled a stark shift. A cumulative 8.6% dip during the week highlights mounting uncertainty in the market. This pullback coincided with a spike in trading activity, with volumes hitting $41 billion within a single day. Such heightened activity points to notable repositioning among market players.

Major altcoins have not been spared from the fallout. Ethereum has plunged by 8%, while XRP and Solana have seen even sharper declines of 10.5% and 12.5%, respectively. Although optimism persists about long-term bullish trends – boosted by expected pro-crypto regulatory developments in the U.S. – short-term sentiment has soured. This negative mood is further reflected in the Fear and Greed Index, which has fallen from last week’s highs, signaling heightened caution among investors.

The Broader Market Picture

While the market struggles for stability, no single factor fully explains the sell-off. Several catalysts are likely influencing investor sentiment. Notably, the looming Federal Reserve meeting on January 29 has injected fresh uncertainty into global markets – especially after recent signals that interest rates may remain high.

Adding another layer of complexity is the rapid emergence of Deepseek R1, a groundbreaking open-source Chinese AI comparable to ChatGPT o1. Offering similar performance at a fraction of the cost, Deepseek R1’s rise has amplified concerns about the U.S. losing its edge in the global AI race. Such developments are likely weighing on both cryptocurrency and stock markets, with investors recalibrating their strategies.

Technical Signals Suggest Further Downside

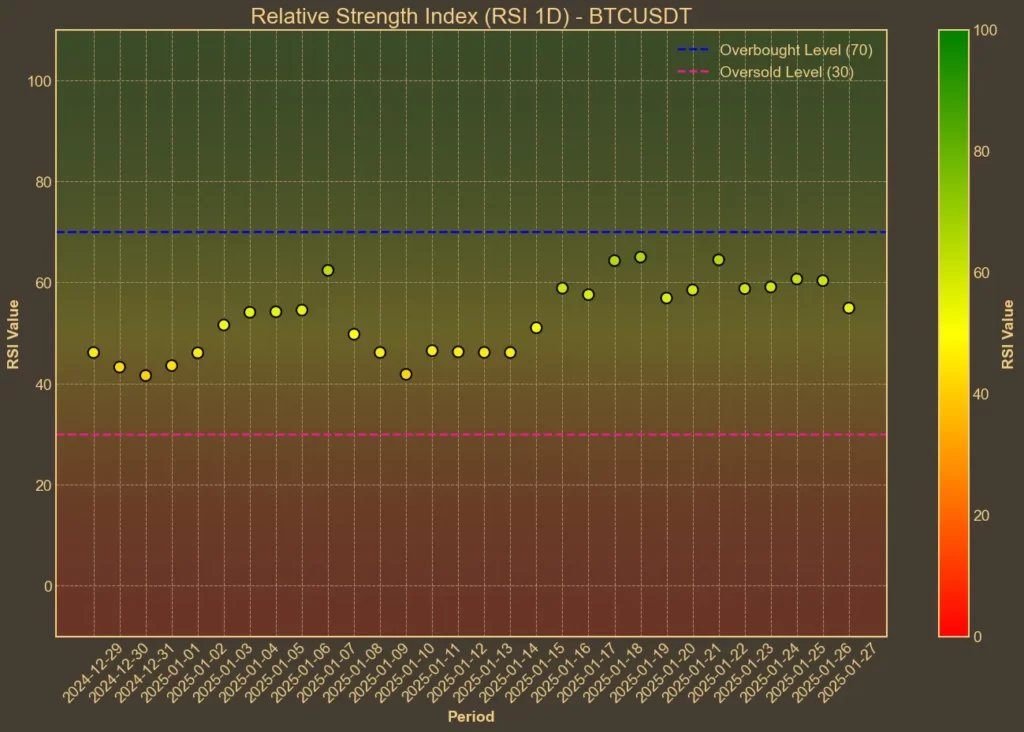

Technical indicators provide further insight into Bitcoin’s current state. The Relative Strength Index (RSI) has been declining, currently sitting at 47, down from 64 a week ago. An RSI below 50 typically signals bearish momentum, suggesting that sellers may be gaining control.

Additionally, the Moving Average Convergence Divergence (MACD) has dipped below the signal line, another bearish sign that could indicate further downward pressure.

The Bollinger Bands reveal that Bitcoin is nearing the upper band, which is close to its all-time high. While this proximity can indicate strength, it also means that Bitcoin may face resistance if it attempts to climb higher. The Average True Range (ATR) shows a moderate level of volatility, suggesting that while large price swings are possible, they may not be extreme.

Limitations of Technical Analysis

While technical analysis offers valuable insights, it cannot fully account for the broader market forces that shape Bitcoin’s trajectory. Key drivers such as regulatory changes, macroeconomic shifts, and unforeseen global events can significantly impact price action in ways that indicators alone cannot predict. This is especially true with investors awaiting new regulatory changes in the United States.

What Lies Ahead?

Bitcoin’s impressive long-term resilience is not in question, but its short-term outlook remains uncertain. With bearish signals dominating the charts and external events, such as the Federal Reserve meeting, on the horizon, investors should brace for further volatility.

Whether this is a momentary pause in a sustained rally or the beginning of a more substantial correction will likely depend on how macroeconomic and regulatory developments unfold in the coming days. Additionally, any major news from United States – such as the developments of a Bitcoin reserve or changes in SEC policies – might serve as a catalyst to reignite investor confidence and provide upward momentum for the crypto market.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!