The cryptocurrency market is once again proving just how unpredictable it can be. Just yesterday, investors were celebrating as Bitcoin and other digital assets soared on the back of Donald Trump’s announcement about a potential U.S. crypto reserve. Now, the excitement has faded, and Bitcoin has slipped back below $90,000, dragging much of the market down with it.

Table of Contents

A Short-Lived Rally

Bitcoin jumped to $94,500 over the weekend after Trump’s statement, which suggested that Bitcoin, Ethereum, XRP, Solana and Cardano would play a role in the country’s strategic digital asset reserves. However, he euphoria was short-lived. Over the last hours, Bitcoin has tumbled back down to $87,000.

Altcoins, which had experienced even bigger gains yesterday, suffered heavier losses today. Ethereum, XRP, Solana, and Cardano have all posted double-digit losses. While some of them are still up compared to where they were yesterday, the weekly picture doesn’t inspire much confidence.

What’s Going On?

Several factors contributed to the sudden reversal. First, Trump’s crypto reserve announcement lacked concrete details. While the idea of a government-backed crypto reserve sounds promising, there’s still no clarity on how it would be funded or whether it’s even feasible to implement.

Global macroeconomic factors are also at play. China’s announcement of retaliatory tariffs against the U.S. spooked markets, sending the S&P 500 down and triggering risk-off sentiment. While cryptocurrencies are often seen as a hedge against economic uncertainty, they’re clearly not immune to investor fears surrounding this escalating trade war. The reason behind this is likely that these tariffs could directly impact many investors, reducing their available capital to put into crypto markets.

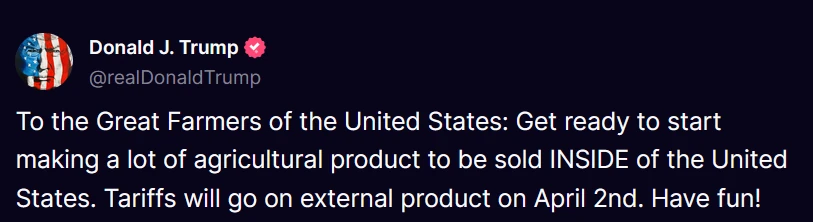

And the retaliatory tariffs are the only concern. New U.S. tariffs against Canada and Mexico are set to begin tomorrow, and Trump’s latest post about agriculture strongly hints that more trade restrictions are on the way.

Another – albeit minor – factor weighing on sentiment is Strategy’s (formerly MicroStrategy) lack of new Bitcoin purchases. Some investors had speculated that the company would jump in and buy more Bitcoin after Trump’s announcement, but Michael Saylor confirmed that their holdings remain unchanged at 499,096 BTC.

More Volatility Incoming

Despite the pullback, the long-term outlook remains optimistic. However, right now, the market is highly volatile, reacting to both bullish and bearish news.

Investors should brace for more swings in the coming days. Macroeconomic uncertainty remains high, and the geopolitical situation has become more complicated following Trump’s recent meeting with Zelensky.

On the positive note, the first White House crypto summit, scheduled for this Friday, could be a game-changer – if it provides more details about the crypto reserve or regulatory developments. But if the results are underwhelming, another drop could follow.

Should Investors Be Worried?

There’s no denying that the past few weeks have been nerve-wracking for crypto investors, but it’s worth remembering that this kind of volatility is nothing new in the cryptocurrency world. Bitcoin has seen sharp crashes before, only to rebound even stronger. Right now, many key macroeconomic factors are uncertain – but once the dust settles, so will the volatility.

Looking at the bigger picture, crypto adoption is growing, and institutional interest has never been higher. Major altcoins are on track to receive ETF approvals this year, and regulatory clarity is finally improving. The SEC has also been scaling back its enforcement actions against crypto companies, signaling a shift away from regulation by crackdown.

These fundamental factors haven’t changed just because of short-term market turbulence. If you believe in your investments, there’s no reason to make emotional decisions based on today’s price swings.

Why cryptocurrencies are so volatile compared to other assets? We described the reasons behind cryptocurrency’s extreme price swings in this article.