The last few hours have been very volatile for Bitcoin – it jumped $4,000 in a few minutes, only to lose almost all of it, and then regain it. The market has been highly active due to political developments after Donald Trump officially took the White House following the inauguration.

Table of Contents

One Letter Started It All

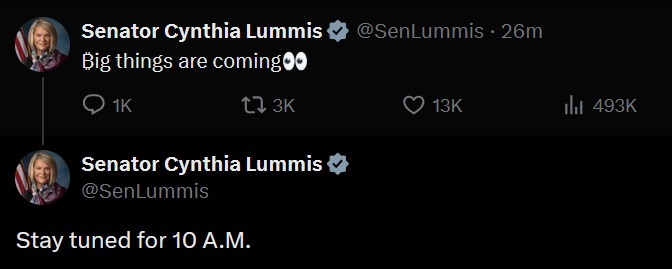

It all started when Cynthia Lummis, a senator and well-known advocate for cryptocurrency, posted mysterious tweets:

As you can see, in the Senator’s message, the “B” letter is replaced with the Bitcoin symbol, which investors interpreted as a sign of bullish news for the crypto sector. Following this, Bitcoin surged from $102K to nearly $106K within just a few minutes. However, when 10 A.M. EST arrived and no announcement was made, the price quickly fell back to around $103K. Some speculated that the Senator might have been referring to Wyoming’s time zone, which is two hours behind EST.

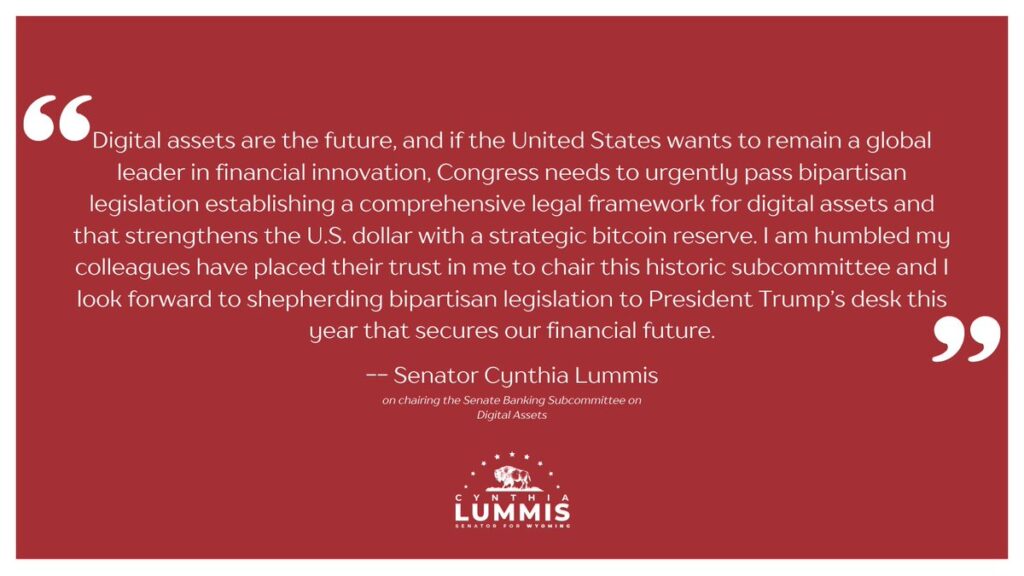

Soon thereafter, the announcement was finally made: Cynthia Lummis took a prominent role by being appointed chair of the Senate Banking Subcommittee on Digital Assets. This news helped Bitcoin regain its momentum, bringing it back near $106K – very close to its current all-time high, which was set only a few days ago.

What Lummis Announced

Lummis is pushing for bipartisan legislation to create a Strategic Bitcoin Reserve, aiming to strengthen the U.S. dollar and secure the nation’s financial future. This move has reassured investors, suggesting that Bitcoin could become a more integral part of the national economy. Her efforts signal a potential shift towards greater regulatory clarity, which many believe could attract more institutional investment.

Donald Trump Comments on Crypto

Donald Trump has also been active. Not long after the Senator’s posts, he spoke at the World Economic Forum (WEF) in Davos, Switzerland. One of the main topics of his speech was about making the United States a leader in AI and cryptocurrency:

We will make the United States a manufacturing superpower and the world capital of Artificial Intelligence and Crypto.

This statement reassured investors that Donald Trump’s pro-crypto promises are serious, although it did not significantly affect Bitcoin’s price.

Market Momentum

Beyond political developments, Bitcoin’s market performance has been robust. After Donald Trump won the elections in November, Bitcoin saw nearly a 50% increase, and in the past month alone, the price has risen by nearly 8%. The market capitalization stands at a staggering $2.1 trillion, with trading volumes reaching almost $74 billion. These figures indicate strong investor interest and a healthy level of liquidity.

The surge in trading volume over the last month suggests more participants are entering the market, either to take advantage of the upward trend or to diversify their investment portfolios. This influx of capital can further drive Bitcoin’s price, creating a positive feedback loop that sustains growth.

Outside of potential pro-crypto changes in the U.S., other developments are also contributing to Bitcoin’s bullish outlook. The introduction of the first U.S. spot Bitcoin ETFs in January 2024 has made it easier for investors to gain exposure to Bitcoin through traditional financial channels, enhancing both accessibility and legitimacy. Furthermore, recent halving event in April 2024 – reducing the block reward from 6.25 BTC to 3.125 BTC – has historically led to price increases due to reduced supply.

What’s Next?

It’s clear that investors are watching for new pro-crypto regulatory changes in the U.S. under Donald Trump. As we’ve seen, any hint of potential developments (even in the form of a tweet from a senator) can spark rapid market reactions.

However, it’s important to remember that political and regulatory changes do not happen overnight and may face opposition or delays. In any case, current developments show a strong intent to improve the cryptocurrency space, which presents a promising outlook for Bitcoin and other crypto assets, especially those based in the U.S.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!