Crypto prices are in the red again. The sell-off started after new government data showed that the U.S. economy shrank in the first quarter of the year. It’s the first contraction in three years, and it’s making investors nervous.

Bitcoin dipped around 1% following the report, but other coins were hit harder. Ethereum and Solana dropped around 3%, and XRP, Cardano, and DOGE all slid more than 5%. That’s not a collapse, but it’s a clear reaction to what’s now unfolding on the macro side.

Table of Contents

The U.S. Economy Just Got Smaller

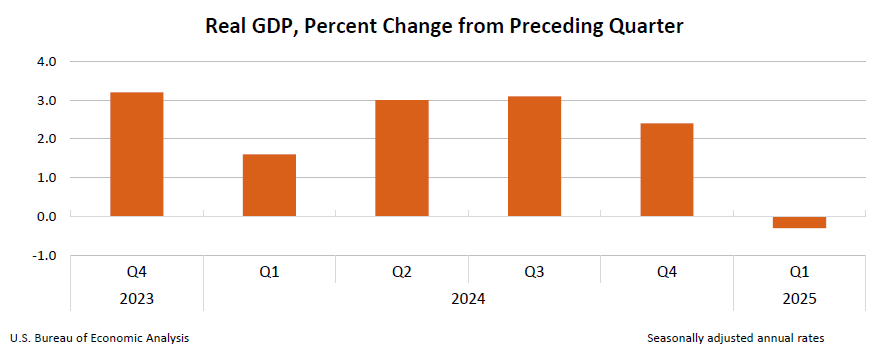

On Wednesday, the Bureau of Economic Analysis released its first estimate of U.S. GDP for the first quarter of 2025. The number came in at -0.3%. That means the economy shrank between January and March. It’s not a huge drop – but it’s the first time that GDP has gone negative since 2022.

To put that into context: in the last quarter of 2024, the U.S. economy was growing at a healthy 2.4% rate. So this isn’t just a slowdown – it’s a reversal.

It’s important to understand where this contraction came from. It wasn’t because people stopped spending money. In fact, consumer demand stayed fairly strong. The issue was imports. Companies rushed to bring in goods from overseas ahead of President Trump’s new tariffs. That import surge dragged the GDP number into negative territory – because in official calculations, imports count as a subtraction.

There were other red flags too. Inflation was hotter than expected. And new data showed that private sector job growth in April was just 62,000 – far below the 115,000 that analysts were predicting.

So while no official is calling it a recession yet, the market got hit with a wave of uncomfortable data all at once – and investors responded the way they usually do during uncertainty, by pulling out of riskier assets. On Polymarket, online betting platform, the odds of a U.S. recession in 2025 jumped to 67% – up sharply from below 55% just a few days ago.

Crypto Reacts, But It’s Not a Collapse

Bitcoin fell around 1% after the news, but it still holds around $94,000. Wall Street saw a much harder hit. The S&P 500 fell 1.4%, and the Nasdaq slid more than 2%. Tech stocks were already under pressure ahead of earnings, and the weak economic numbers added fuel to the fire.

Still, the fact that crypto prices dropped at all shows how closely tied the market is to broader investor sentiment. Crypto might not be affected directly by tariffs or import costs, but it still trades like a risk asset – and when people feel uneasy about the economy, they reduce risk wherever they can.

Looking Ahead

The real question now is whether this is a one-off blip or the start of something bigger. If the U.S. economy continues to slow, we could see more selling across all markets. If inflation stays high, it might delay the Federal Reserve’s expected interest rate cuts – and that could keep pressure on everything from tech to crypto.

But it’s not all negative. Some parts of the data were better than expected. Consumer demand was strong. Inflation, while above forecasts, wasn’t out of control. And even with a shrinking economy, there’s still no official signal of recession.

For crypto investors, this probably isn’t the moment to panic – but it might be a time to stay alert. If traditional markets keep slipping, crypto could dip further. But unless we see something more serious, like a wave of forced liquidations or major outflows, this week’s movement looks more like a reaction than a warning.

Read also: 6 Reasons Why Crypto Is More Volatile Than Other Assets