Over the past week, Sui has surged by more than 25%, largely propelled by Grayscale’s decision to open a Sui Trust for accredited investors. This move has injected a wave of institutional confidence into the asset, leading to a notable increase in market capitalization and trading volume.

Technical Indicators Signal Strong Momentum

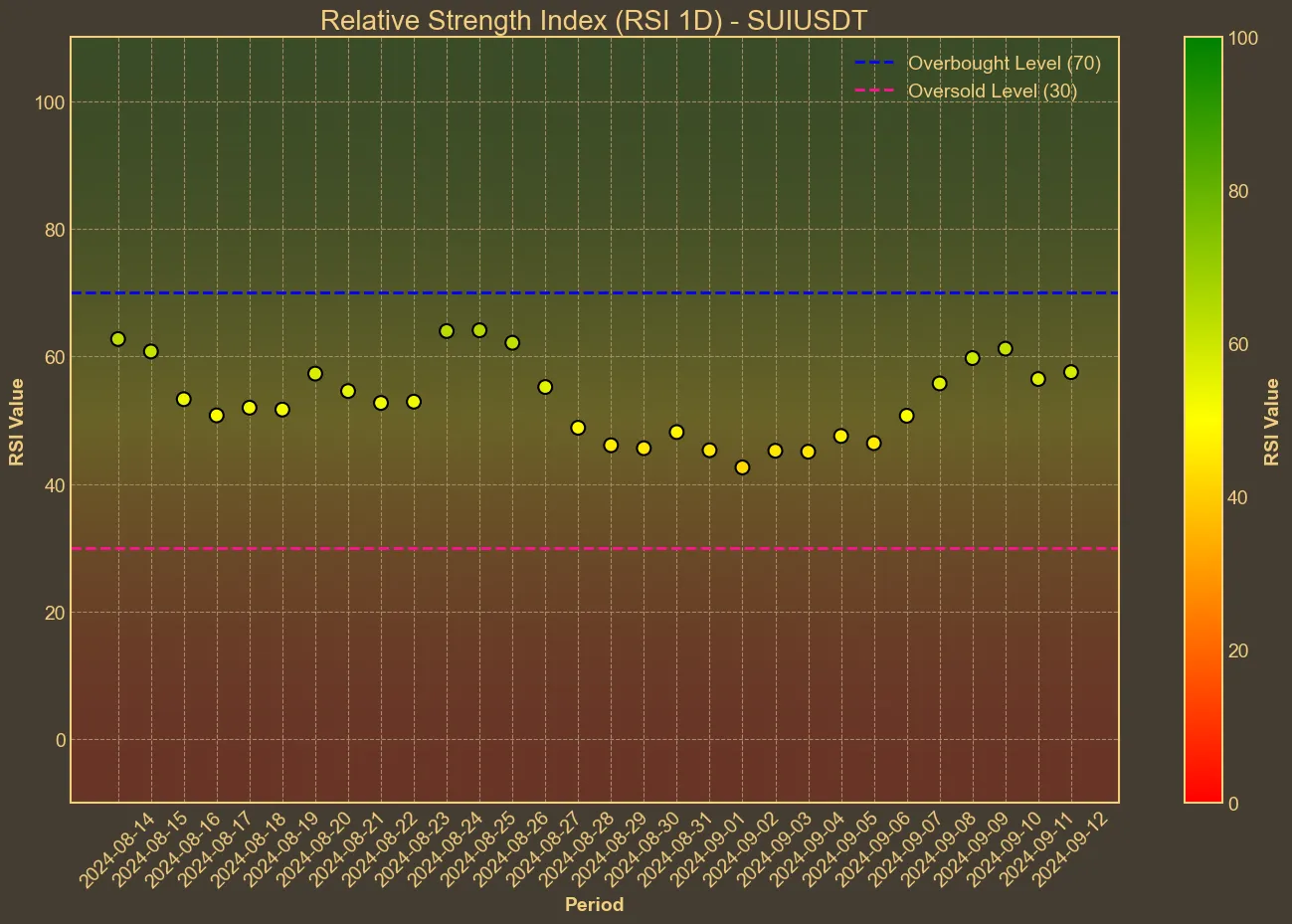

A closer look at technical indicators reveals a bullish momentum for Sui. The Relative Strength Index (RSI) has moved from 46 to 66 over the past week, suggesting growing buying interest without yet entering overbought territory. Meanwhile, Sui’s Moving Average Convergence Divergence (MACD) continues to trend positively, with the MACD line above the signal line, pointing to continued upward potential. Complementary to this, rising trading volumes further underline strong market interest, hinting at sustained momentum.

The Simple Moving Average (SMA) and Exponential Moving Average (EMA) reflect a similar uptrend, with current values at $0.88 and an immediate resistance level forming around the $1.10 mark. Notably, the Bollinger Bands show a widening gap, indicating increased volatility but also potential for significant price action.

Market Dynamics and Future Outlook

The rapid volume change, up 85% in the last three days, signals heightened trading activity. This is often a precursor to continued price movements, either upwards or in correction. The Awesome Oscillator (AO) has flipped from negative to positive territory over the past week, further supporting the bullish thesis.

However, it is essential to acknowledge the inherent limitations of technical analysis. While current indicators show a positive trend, market conditions can shift rapidly. The bullish signals may continue to hold unless interrupted by unforeseen market events or investor behavior changing drastically. A price breach past the $1.10 level could drive a stronger rally, but a dip below the $0.90 support could indicate a potential reversal or consolidation phase.

In conclusion, Sui’s recent performance showcases a robust upward trajectory supported by institutional backing and favorable technical indicators. As always, while the outlook is currently positive, ongoing vigilance and comprehensive analysis remain crucial for any trading strategy.