Sui, a relatively new blockchain launched in 2023, has entered the spotlight for its promise of faster transactions and low costs. This has led to it being labeled a potential “Solana killer” – a title that comes with high expectations and deeper comparisons. But while both Sui and Solana cater to similar crypto audiences, recent developments, including a 33% price drop in Sui’s token, raise questions about whether Sui can truly match or surpass Solana’s established presence.

Table of Contents

Sui Outperforms Solana in Speed, Stability, and Cost

One of the core strengths behind Sui’s is its performance. With real-world tests showing the capacity to process around 300,000 transactions per second, Sui surpasses Solana’s previously known throughput ceiling of approximately 50,000 TPS. This is made possible by a dual consensus system – Narwhal for data and Bullshark for transaction ordering – allowing parallel processing and faster validation.

Solana also leverages a combination of Proof-of-History and Proof-of-Stake, offering up to 65,000 TPS theoretically. However, actual performance often falls short of this, especially during periods of network congestion. Several outages, including one as recent as 2024, have put Solana’s reliability into question despite its strong infrastructure.

Transaction costs on both chains remain low, typically under a cent. But where Solana occasionally sees fee spikes, Sui’s design ensures more stable and predictable fees, even during peak usage. This helps retain developers who prioritize consistent performance and cost planning.

Solana’s Maturity vs. Sui’s Momentum

Solana’s strength lies in its mature ecosystem. Launched in 2020, it has seen widespread adoption in decentralized finance, NFT marketplaces, and meme coin projects. The platform has built a foundation with community funding programs and partnerships that keep developer activity high. Solana’s Total Value Locked (TVL) rose nearly $12 billion in late January 2025 before bouncing back to the current level of $8.11billion, according to DefiLlama.

Sui is still early in its development, but it is expanding fast. Developer grants and educational programs from Sui Labs have helped onboard new teams and projects. Sui TVL jumped approximately 40% from its April 9 low of $1.10 billion, suggesting growing traction, especially in DeFi. Even so, it remains a few billion short of Solana’s levels.

The developer environment also differs. Solana uses Rust and C for its smart contracts, while Sui uses the Move language, originally designed during the Diem (Facebook) project. Move treats digital assets as objects, which simplifies how developers interact with tokens, possibly reducing development errors.

Why Institutions Trust Solana More Than Sui

When it comes to large-scale capital, Solana maintains the lead. It has attracted about $80 million in institutional inflows this year alone. Sui is close behind with around $72 million, but this slight difference reflects more than just investment – it shows confidence in Solana’s infrastructure and application diversity.

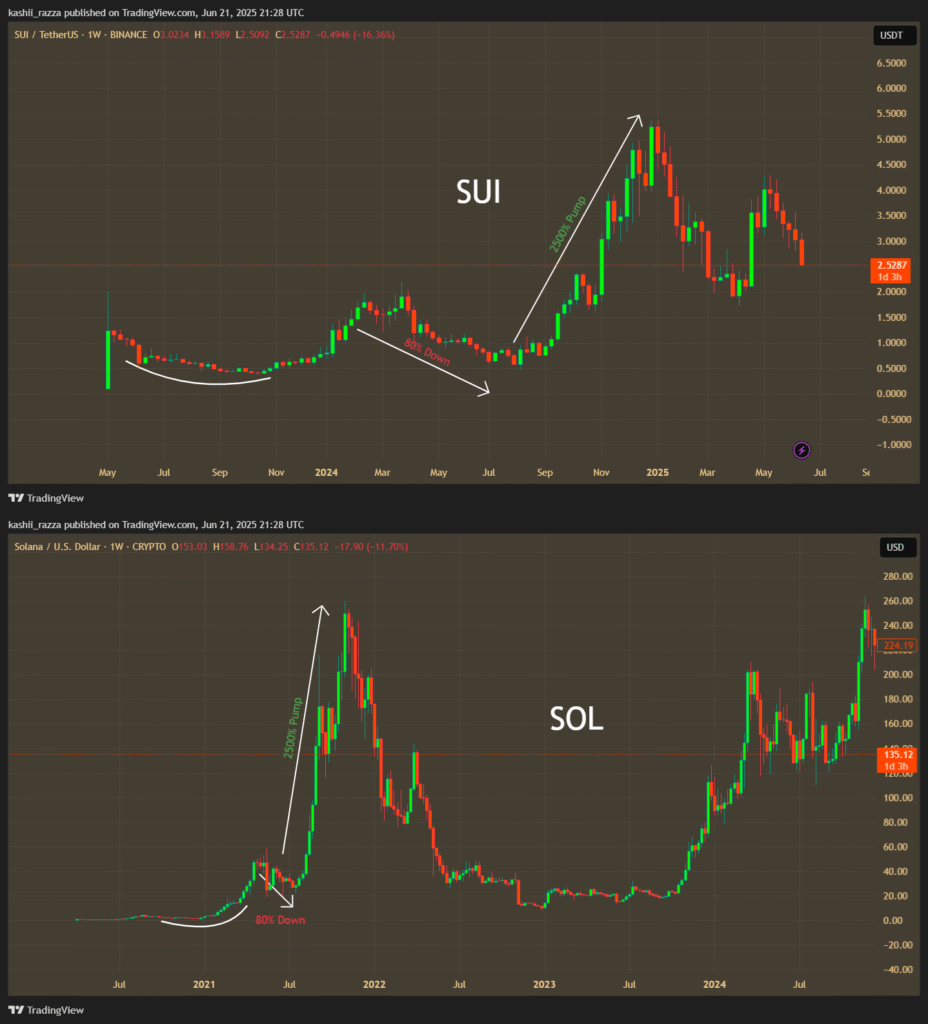

Speculators often compare Sui’s early charts to Solana’s historic performance before its 2500% run-up. However, this parallel overlooks the groundwork Solana laid before that growth. The real test for Sui will be whether it can retain interest without riding solely on hype.

Read also: SUI Stays Strong Despite First Major Outage

Sui Falls 33% in Last Month

Sui’s rising fame took a hit recently with a steep monthly decline in token price. Currently trading at $2.51, SUI fell over 33% in a single month. That wasn’t just a dip – it set off alarms across trading desks and among holders. Analysts cited broken support at $3.10, which has exposed the token to risks of dropping further, even to near $1.90.

Technical indicators like the MACD and RSI show a bearish trend, reinforcing those concerns. Some models now place expected support between $2.33 and $2.39, and others caution against further decline if key levels fail to hold.

Read also: $260 Million Exploit Forces SUI’s Cetus Protocol to Halt Operations

Despite its recent drop, Sui hasn’t lost everything. Upgrades like Mysticeti have improved network speed and lowered hardware demands for validators, making participation in the network more attractive.

While speculation around an Sui ETF adds another possible trigger for recovery, most signs still favor Solana in that race. Broader adoption by investment funds could help, but only if Sui also proves its value through real applications and not just performance numbers.

Does “Solana Killer” Status Hold Any Ground?

The term “Solana killer” suggests a direct challenge to Solana’s role in the market. On performance metrics like speed and cost, Sui presents a compelling technical case. It can handle high throughput without raising fees, thanks to its efficient architecture.

But speed and fee stability alone don’t build a network. Solana’s strength comes from its broad application base – projects like Bonk, Jupiter, and Render all keep user interest. For Sui to live up to the title, it needs applications that draw consistent user activity and institutional capital.

There’s also an issue of how transactions are counted. Critics have noted that Sui may be overstating activity by labeling object-level instructions as separate transactions. This method inflates numbers and makes direct comparisons with Solana misleading.

Final Thoughts: Promise vs Proof

Solana has years of market activity, a deep ecosystem, and ongoing developer support. It continues to dominate DeFi rankings and handles billions in value daily. Sui has potential and already shows impressive technical benchmarks, but it hasn’t yet passed the test of time.

While Sui can be seen as a fast up-and-comer, surpassing Solana will require more than speed. It must build a lasting ecosystem, attract long-term capital, and survive volatile periods like the one it just experienced. Until that happens, calling it a “Solana killer” is premature. The foundation is there, but turning potential into presence is the real challenge.

Read also: Why Solana’s Speed Isn’t Enough to Dethrone Ethereum?