Solana is rebounding strongly from recent corrections, gaining 12% over the past week and reclaiming its position as the 5th largest cryptocurrency by market cap, overtaking BNB. This resurgence, coupled with new developments surrounding the coin, has reignited investor confidence.

Riding the Wave of Growth

For the past two weeks, Solana has hovered around the $185 price mark. However, the recovery began a few days ago, pushing Solana to its current trading level of approximately $216. Although this is still about 10% below last 30 days high, the broader outlook remains positive, particularly given Solana’s impressive long-term growth.

One of the key factors contributing to Solana’s strong performance over the last months is the growing interest in its ecosystem. The platform is known for its fast transaction speeds and low costs, making it a favorite for decentralized finance (DeFi) projects, memecoins and non-fungible tokens (NFTs). As more developers and users flock to Solana, the demand for its native token, SOL, naturally increases, driving up its price.

Moreover, ongoing discussions about the approval of Solana exchange-traded funds (ETFs) could further boost its standing in the market. With firms like Grayscale and VanEck filing applications for Solana ETFs, there’s a growing belief that regulatory acceptance is on the horizon. If approved, this could open the doors to even more substantial investments, driving Solana’s price higher and solidifying its position in the crypto hierarchy.

Solana Technical Analysis

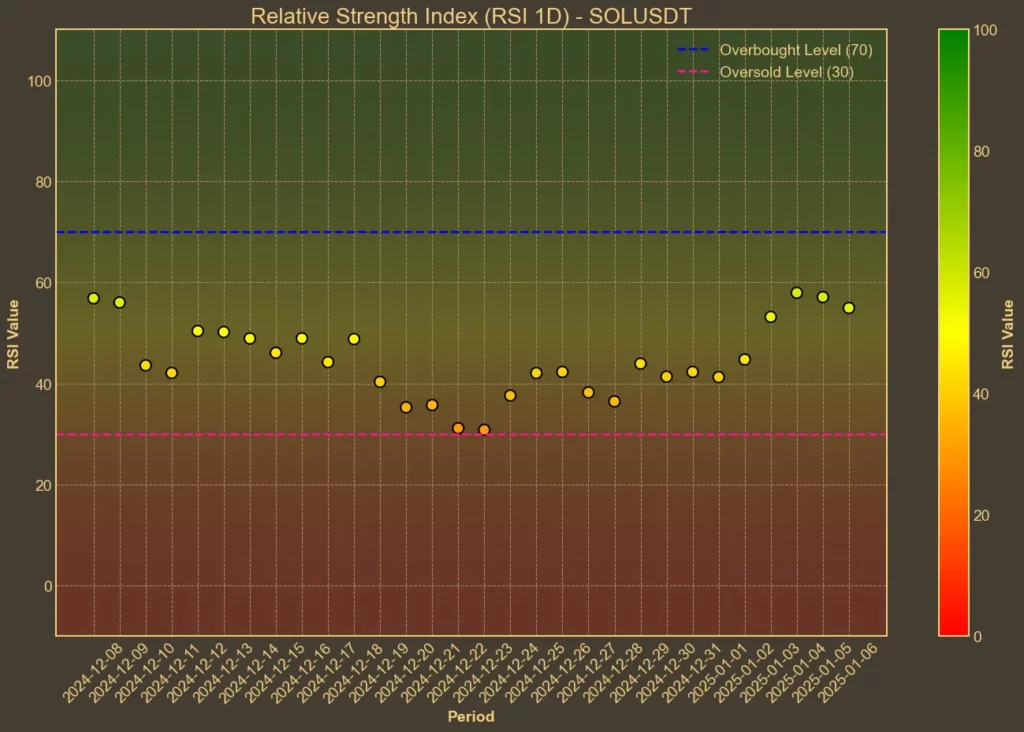

Technical indicators provide further insight into Solana’s current state. The Relative Strength Index (RSI) at 56 indicates that the asset is neither overbought nor oversold, suggesting a balanced market sentiment.

Moving averages are closely aligned, with the Simple Moving Average (SMA) and Exponential Moving Average (EMA) converging around the $205 mark. This alignment often points to a period of consolidation, where the price may stabilize before making a significant move.

The Moving Average Convergence Divergence (MACD) is nearly neutral, signaling that there is no strong momentum in either direction at the moment. Additionally, the Average True Range (ATR) of 12 highlights the current volatility level, which traders should monitor closely. The Accumulation/Distribution Oscillator (AO) is showing a positive trend, moving from negative values to positive, indicating a shift towards buying pressure.

Quantum-Resistant Innovations

Beyond the recent renewed interest around the coin, Solana is also taking important steps to ensure its long-term security and sustainability. Recently, Solana introduced the “Winternitz Vault” a quantum-resistant feature designed to protect user funds from potential threats posed by quantum computers.

While quantum computing is still in its early stages, it holds the potential to disrupt current cryptographic systems. By proactively addressing this, Solana is positioning itself as a forward-thinking platform committed to safeguarding its users’ investments.

The Winternitz Vault uses advanced cryptographic techniques to generate new keys for every transaction. This means that even if quantum computers become powerful enough to challenge current security measures, Solana’s system would remain robust and secure. This feature is optional, allowing users to choose whether they want to take advantage of this enhanced security without forcing widespread changes across the network.

This move has been well-received in the crypto community, as it demonstrates Solana’s commitment to staying ahead of technological advancements. Investors can have greater confidence knowing that their assets are protected by state-of-the-art security measures, adding another layer of trust to the platform.

For more on the potential risks quantum computing poses to crypto, check out our article on this topic!

Summary

Solana’s combination of popularity, strong price performance and security enhancements paints a promising picture for the cryptocurrency for the coming weeks. The introduction of the Winternitz Vault not only fortifies Solana’s security but also showcases its dedication to evolving alongside technology trends. Potential approval of Solana ETFs adds another layer of optimism.

Of course, the cryptocurrency market is always subject to changes, and staying informed is crucial. While technical analysis can guide decisions, it cannot predict unforeseen events. However, based on the current trends and developments, Solana appears to be a promising option for those looking to invest in a robust and forward-thinking blockchain platform.