Solana, currently ranked #5 in the cryptocurrency market, has shown a mixed but interesting trend in recent weeks. The current price of $147 represents a continued positive trajectory over the last month, with a 9.% increase, suggesting a steady climb and recover from last dips. This gradual rise contrasts with the overall trading volume, which has seen a decline of 6.1% over the same period. This discrepancy indicates a potential tightening of supply as less Solana changes hands, possibly hinting at accumulating interests among investors.

Market Trends and Technical Indicators

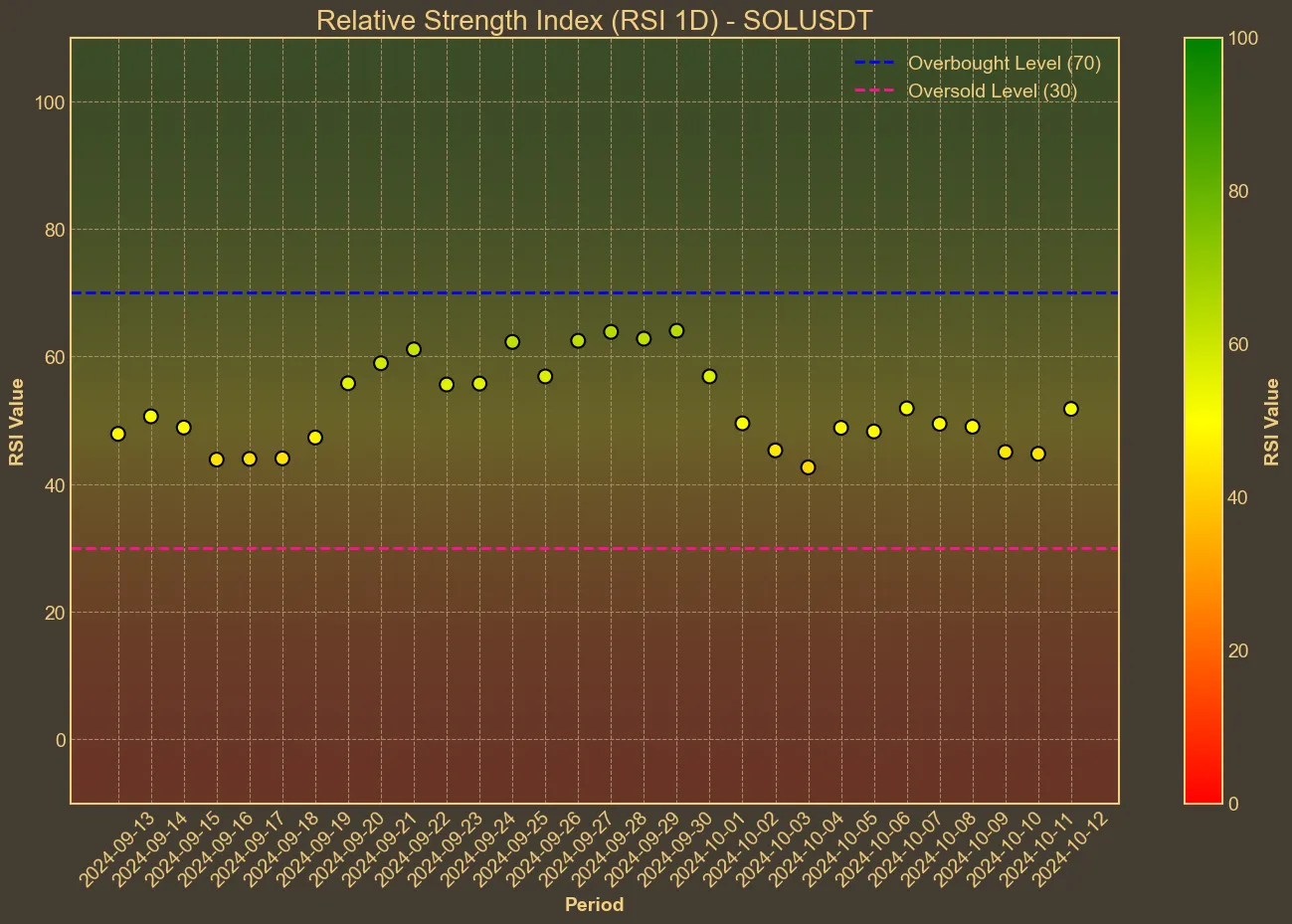

Analyzing Solana’s technical indicators reveals a narrative of subtle growth and consolidation. The Relative Strength Index (RSI) slightly increased to 53, pointing to a balance between buying and selling pressures; neither bullish nor bearish.

Meanwhile, the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) both indicate a stable price level, hovering around the historical $144 price point. However, the Awesome Oscillator (AO) turning negative recently might suggest a cautious approach in the short term.

The Bollinger Bands suggest a potential for price expansion, as the current price approaches the higher band limit of $160. This may signal an imminent increase in price volatility and possible upward breakout, especially if buyers gain momentum and push past the resistance at $144. Yet, the Moving Average Convergence Divergence (MACD) and the signal lines being at or near equilibrium imply that significant bullish or bearish trends haven’t firmly established yet.

Opinions and Limitations of Technical Analysis

Solana’s position in the market and its technical readings suggest there’s a possibility for upward momentum, but the technical underpinnings do not outright confirm this speculation. While historical price increases provide optimism, one must be aware of the limitations of technical analysis. It is essential to remember that these indicators are backward-looking and do not account for sudden changes contingent on broader economic news or unforeseen market events.

While Solana enjoys a favorable position at present, consistent scrutiny of market conditions remains paramount. Future movements could be influenced by external factors such as regulatory news or shifts in market sentiment that lie beyond the predictive capacity of current technical indicators. As always, due diligence and strategic risk management should precede any investment action.