Solana (SOL) has been facing downward pressure in recent weeks, with its price now hovering around $125. The cryptocurrency has lost 35% over the past month, and nearly 45% in the past quarter. Despite a brief attempt at recovery, market conditions remain uncertain, raising the question: Will Solana be able to recover, or is further downside likely?

Table of Contents

Momentum Indicators

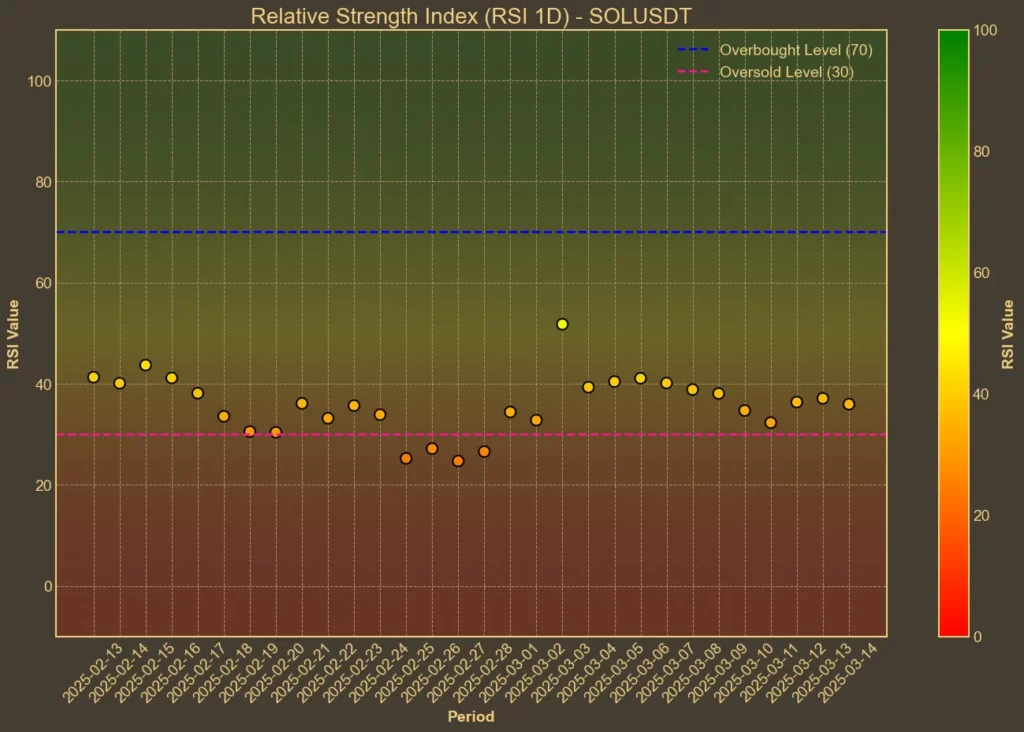

RSI: Neutral

The Relative Strength Index (RSI) helps determine whether an asset is overbought or oversold. Currently, Solana’s RSI(14) is 38, slightly up from 36 yesterday, but nearly unchanged from 39 a week ago. The short-term RSI(7) shows a similar pattern at 39 today, compared to 35 yesterday. These readings suggest that while Solana is nearing oversold conditions, there is no clear sign of a reversal yet.

MFI: Neutral

The Money Flow Index (MFI) incorporates both price and volume to gauge buying pressure. Solana’s MFI(14) is at 48, down from 53 yesterday, but slightly up from 43 a week ago. This fluctuating movement indicates that while there is some buying activity, it’s not strong enough to shift market sentiment.

Fear & Greed Index: Fear

The broader crypto market sentiment is still cautious. The Fear & Greed Index currently sits at 27, reflecting fear among investors. This is a notable drop from 45 yesterday and remains lower than the 34 recorded a week ago.

Moving Averages

SMA & EMA: Bearish

Solana’s moving averages continue to point downward. The SMA(9) and EMA(9) are both at 130.0, while the SMA(26) is at 147.0 and EMA(26) at 148.0. The fact that both short-term and long-term moving averages are higher than the current price suggests that bearish momentum remains in control.

Bollinger Bands: High Volatility

Bollinger Bands help assess volatility and potential breakout zones. The upper band stands at 168.0, while the lower band is at 111.0. With Solana’s price closer to the lower band, this could indicate oversold conditions. However, it also highlights the increased volatility in the market, meaning further downside is still possible.

Trend & Volatility Indicators

ADX: Moderate Trend Strength

The Average Directional Index (ADX) measures the strength of a trend. Solana’s ADX(14) is at 33, unchanged from yesterday and slightly higher than 32 a week ago. While this suggests a moderate trend, it does not confirm a strong shift in direction yet.

ATR: Decreasing Volatility

The Average True Range (ATR) tracks price volatility. Today’s ATR(14) is 14.0, down from 15.0 yesterday and 17.0 a week ago. The declining ATR suggests that market volatility is stabilizing, which may indicate a period of consolidation before the next major move.

AO: Bearish

The Awesome Oscillator (AO) is used to confirm trend momentum. Solana’s AO is currently -36.0, the same as yesterday but worse than -28.0 a week ago. This indicates that the downward momentum remains strong.

VWAP: Bearish

The Volume Weighted Average Price (VWAP) for Solana today is 199.0, significantly higher than its current price. This suggests that Solana is trading well below its fair value when adjusted for trading volume, reinforcing the bearish outlook.

Relative Performance

Comparison Against ETH: Mixed

The SOL/ETH ratio is currently 0.0664, reflecting a 2% increase in the past seven days, but a 8.5% decline over the past month. While Solana has slightly outperformed Ethereum in the short term, its longer-term trend remains weak.

Market News & Price Drivers

Several external factors are weighing on Solana’s price. A major contributor to the recent decline is the continued liquidation of FTX’s assets, which includes large amounts of SOL. This has added significant sell pressure to the market. Since November, over 8 million SOL tokens have been unstaked, fueling concerns that further sell-offs could continue to impact Solana’s price.

On the regulatory front, there are some positive news – Franklin Templeton has filed for a Solana ETF, which, if approved, could attract institutional investment and provide price stability. According to the betting platform Polymarket, the probability of Solana securing ETF approval in 2025 is over 80%.

Conclusion

Solana’s technical indicators paint a mixed picture. On one hand, RSI and Bollinger Bands suggest that Solana is approaching oversold conditions, which could lead to a temporary bounce. However, moving averages, trend indicators, and trading volume suggest that bearish momentum is still dominant. The ongoing liquidation of FTX’s assets further complicates the outlook.

While a short-term relief rally is possible, there are no clear reversal signals yet. Until selling pressure eases and volume picks up, Solana may struggle to break above key resistance levels.

Some media outlets are promoting Solaxy, a new coin claiming it to be the first Solana layer-2 solution. But before you get caught up in the hype, you should know that our investigation uncovered serious red flags. If you’re considering investing in this presale, make sure to read our report first.