Solana, currently ranked as the fifth largest cryptocurrency by market cap, has been showing intriguing signs in recent technical analysis. Although there was a significant gain of 9% over the past month, the last week saw a decline of 11.6%, indicating a tempestuous period for Solana, caused mainly by geopolitical tensions. This mixed performance paints a complicated picture, as Solana’s growth over the quarter remains positive, and an impressive 499% increase over the year underlines its potential. Yet, the short-term losses can’t be ignored and pose a challenge for traders trying to predict Solana’s near-term trajectory.

Technical Indicators Reflect Caution

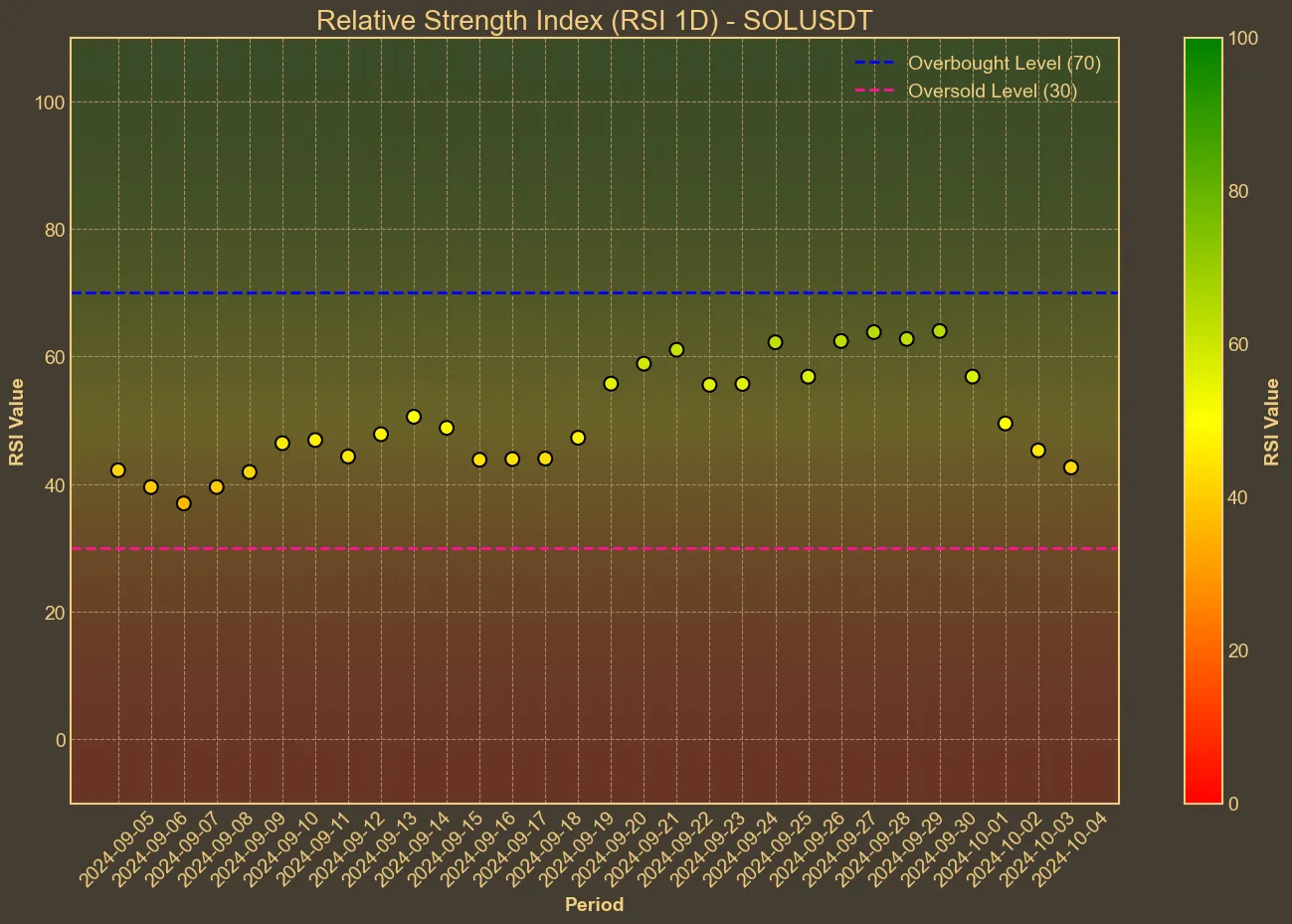

Despite the promising long-term growth, the current technical indicators advise some caution. The Relative Strength Index (RSI) has recently dropped into the mid-40s, suggesting a balance between buying and selling pressures without any decisive direction.

Meanwhile, the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) reveal mild fluctuations. They continue to hover near the current price of Solana, signaling that recent price actions are not out of line with historical trends.

Meanwhile, the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) reveal mild fluctuations. They continue to hover near the current price of Solana, signaling that recent price actions are not out of line with historical trends.

For more technical insights, the Bollinger Bands demonstrate some level of caution, with the trading activity occupying a comfortable middle between the upper and lower bands. The Moving Average Convergence Divergence (MACD) showing a positive value suggests some underlying bullish sentiment, even if faint. Still, the Awesome Oscillator (AO) has been decreasing over the past week, hinting at potential waning momentum.

Market Sentiments and Broader Implications

Recent news adds another layer of complexity to Solana’s narrative. Remarks from Edward Snowden about Solana’s centralization sparked debates over its governance, but community reactions indicate a robust defense of the network’s long-term potential. Meanwhile, PayPal’s retreat from Solana’s stablecoin ecosystem could have implications for future liquidity and usage. Yet, despite these potential headwinds, reports suggest there’s still bullish sentiment, as indicated by favorable funding rates.

It’s crucial to remember that technical analysis, while valuable, has its limitations. Predictions can be undermined by unforeseen market shifts or external news events, as evidenced by Solana’s recent fluctuations. Traders and investors should consider these factors alongside the technical indicators. On the surface, Solana’s price seems poised for a potential recovery, but the recent volatility reminds us that the road to sustained growth can be unpredictable.