Solana has been experiencing significant price movements recently. At the moment, its price is $127, positioning it as the 5th largest cryptocurrency by market cap. It has seen a more substantial decline of 5.73% over the past day due to huge stock drops, particularly NVIDIA. Moreover, a broader look reveals a 14.04% decrease in the past week. Despite these losses, the longer-term picture is notable, with a staggering year-over-year price increase of 560.69%.

Indicators and Technical Setup

The technical indicators offer a mixed picture. Both the Simple Moving Average (SMA) and Exponential Moving Average (EMA) hover around $143 today, slightly below their values from a week ago. This hints at a minor bearish trend in the short term.

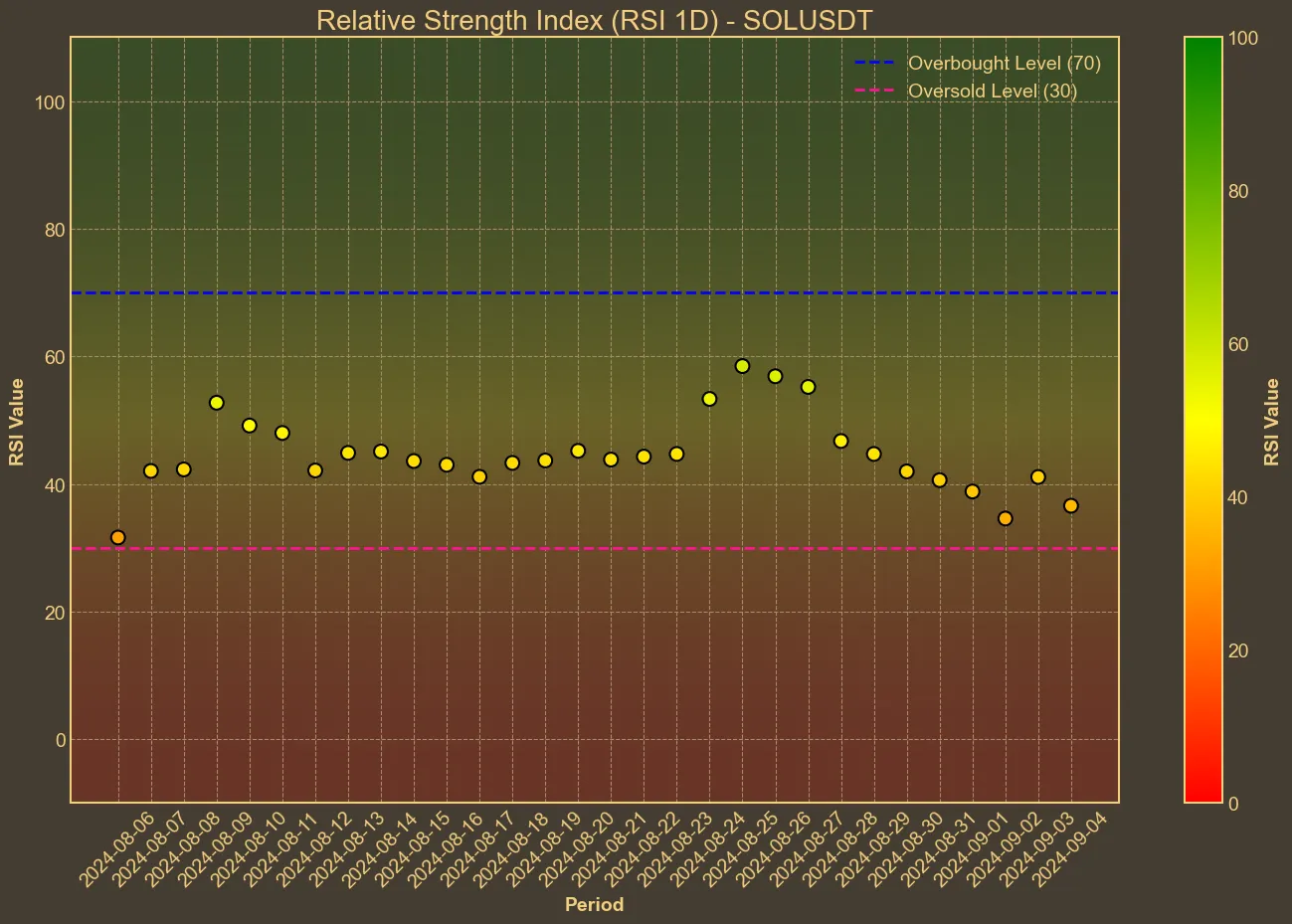

The Relative Strength Index (RSI) at 36 suggests that Solana is nearing oversold territory, which could indicate a potential buying opportunity if the trend continues. Concurrently, the Bollinger Bands show a range between $124 and $161, indicating the current price is closer to its lower support level.

Another significant point is the Moving Average Convergence Divergence (MACD), which stands at -6, with a signal line of -4. This suggests a bearish trend, further confirmed by the Awesome Oscillator (AO), which has been consistently negative over the past week. However, the increased trading volume, with a 26.11% rise in the last 24 hours, demonstrates that investor interest remains strong.

Market Implications

These technical signals imply a period of caution for traders. While the long-term growth prospects for Solana are impressive, the short-term indicators present some risks. The bearish movements in SMA, EMA, and AO, combined with a near-oversold RSI, suggest the potential for more downward action in the immediate future. It’s crucial to remember that technical analysis has its limitations; external factors such as regulatory news or broader market sentiment can significantly impact price movements – just like yesterday.