If you’re holding Solana and plan to keep it for more than just a few days, staking is something that shouldn’t be overlooked. Not only does it offer additional rewards, but skipping it can actually lead to long-term value loss due to token inflation. The same logic applies to other proof-of-stake assets like Ethereum and Cardano – but Solana’s higher reward rate makes the difference even more noticeable.

Table of Contents

What Is Staking?

Staking is a core mechanism in proof-of-stake blockchains. It allows users to freeze their tokens and earn rewards in return – typically several percent annually. By staking, you’re helping to keep the network running securely. The blockchain uses staked tokens to validate transactions – similar in function to Bitcoin mining, but instead of using electricity and hardware, you’re contributing your tokens.

We’ve covered how staking works in more detail in this article.

There is an important distinction to be made here. Some centralized platforms let users “stake” almost any coin, even ones like Bitcoin or XRP that don’t support staking natively. In those cases, what’s actually happening is closer to lending. The platform holds your tokens and gives you a portion of the return they generate elsewhere. It may look the same, but technically and structurally, it’s not staking. It’s also worth mentioning that when you do this, your tokens are no longer under your direct control.

Staking on proof-of-stake blockchains like Solana works differently. It is built directly into the protocol. You’re not lending anything to a third party – your tokens remain yours, and the blockchain itself handles the reward distribution.

That’s what makes skipping staking such a significant oversight – it’s not just a bonus feature, but a key part of how the token economy works.

Why You Can’t Ignore Staking

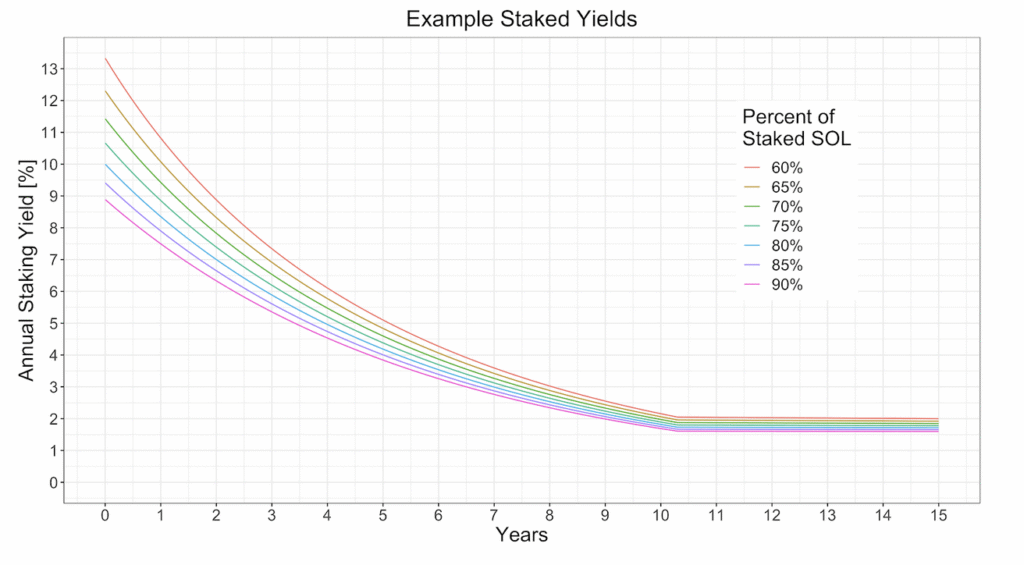

Solana has a built-in inflation schedule. The network launched with an 8% inflation rate, and this figure drops by 15% every year until it reaches a long-term floor of 1.5%. Right now, the inflation rate is estimated to be around 4.5%, though the exact number may change depending on usage and protocol decisions.

If your tokens are sitting idle and not staked, they are being diluted at roughly 4.5% annually. Over time, that’s a significant loss in purchasing power, especially if your intention is to hold for the long term.

Staking offers a direct way to counter that. The staking yield- currently around 7-8% annually – is higher than the inflation rate. That means staking doesn’t just protect your holdings from inflation, it actually results in a net gain. The APY can vary slightly, based on how much of the total supply is staked. When fewer people are staking, rewards increase. At the moment, approximately 65% of the entire Solana supply is staked.

What Are the Risks of Staking?

Staking SOL means your tokens are frozen for a short period. If you need to trade quickly or want instant liquidity, staking might not be the best fit. Once you choose to unstake, your tokens don’t become available immediately – you’ll need to wait until the end of the current epoch, which takes roughly 2-3 days. This waiting period exists because changes to staking are processed on a schedule, not instantly.

This is why staking is more suitable for people who intend to hold for weeks or longer. If you’re actively trading or trying to react quickly to price changes, the delay could be a disadvantage. But for long-term holders who aren’t planning to sell in the near future, the benefits of staking usually outweigh the inconvenience of the lock-up period.

Check Whether You Can Stake Other Tokens

Solana isn’t the only proof-of-stake coin that offers staking, but it is one of the most rewarding in terms of percentage. That’s largely due to its relatively high inflation, which means the difference between staking and not staking is also more significant.

At the time of writing, these are the estimated staking rewards on several major proof-of-stake networks:

- Ethereum: ~3% APY

- SUI: ~2.3% APY

- BNB: ~2.5% APY

- Cardano (ADA): ~2.5% APY

These figures vary over time and by validator, but they show a clear trend – even a few percent makes a meaningful difference, especially over long periods. For smaller altcoins, it’s worth checking whether they offer native staking, what the inflation rate is, and how the staking mechanism works.

Staking should not be viewed as a side option – for many proof-of-stake coins, it’s an essential part of holding the token itself. Ignoring it can mean missing out on returns and slowly losing value due to inflation.