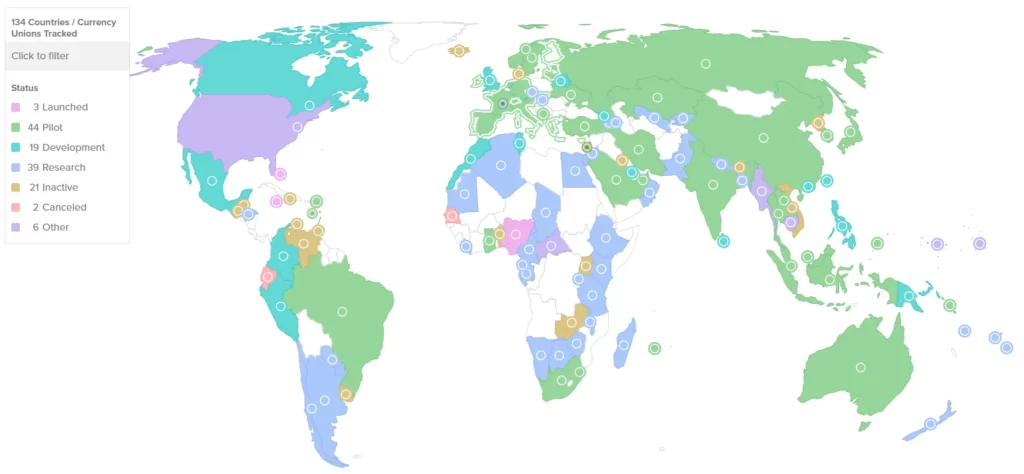

The Digital Euro initiative refers to efforts led by the European Central Bank (ECB) and the European Union (EU) to launch a digital version of the euro as 134 countries worldwide follow the broader trend in central bank digital currencies (CBDCs) creation. The goal is to modernize payment methods, give more people access to financial systems, and keep control over money as everything becomes more digital.

Table of Contents

The Journey of the Digital Euro Initiative

The ECB first explored the idea of a Digital Euro in December 2019, leading to a detailed report in October 2020. A public consultation followed in early 2021, revealing initial enthusiasm for the concept. By July 2021, the project entered the investigation phase, focusing on the design and distribution models, including blockchain-based issuance tests.

In September 2022, ECB teamed up with companies like Amazon, CaixaBank, Worldline, EPI, and Nexi to build and test how people would interact with it. In October 2023, the project entered another phase to finalize legal matters and choose the needed infrastructure. Before that, in June 2023, the European Commission proposed laws to regulate it, aiming to ensure security and privacy.

By January 2025, ECB President Christine Lagarde and European Commission President Ursula von der Leyen stressed its importance, seeing it as a way to keep Europe strong in digital finance while U.S.-backed cryptocurrencies gained traction. The ECB remains committed to rolling out the Digital Euro, with progress continuing in March 2025.

U.S.-Backed Stablecoins: A Threat to the Euro?

Even while the ECB developed its digital currency, concerns grew over U.S.-linked stablecoins gaining too much traction. European officials warned that more support for dollar-based crypto in the U.S. could weaken the euro, putting Europe’s financial independence at risk. The European Stability Mechanism (ESM) noted that major tech companies might use such stablecoins to build their own financial systems, avoiding European banks.

To counter this, the European Commission started reviewing the Markets in Crypto-Assets (MiCA) directive, aiming to tighten regulations on stablecoins and stop them from shaking Europe’s economy. The ECB has also ramped up efforts to ensure that the digital euro remains competitive and widely accepted, seeing it as a key balance against private and foreign-backed digital assets.

At the heart of this push is a broader debate over financial control. Policymakers believe a digital euro is needed to stop Europe’s payment system from falling under non-European influence. Without a strong alternative, they fear the U.S. dollar will keep growing in digital finance.

Among 134 countries exploring CBDCs, 65 countries are in advanced stages of exploration – development, pilot, or launch phases. Notably, every G20 country is exploring a CBDC, with 19 of them in advanced stages and 13 already in the pilot phase, including Brazil, Japan, India, Australia, Russia, and Turkey.

Do Europeans Even Want a Digital Euro?

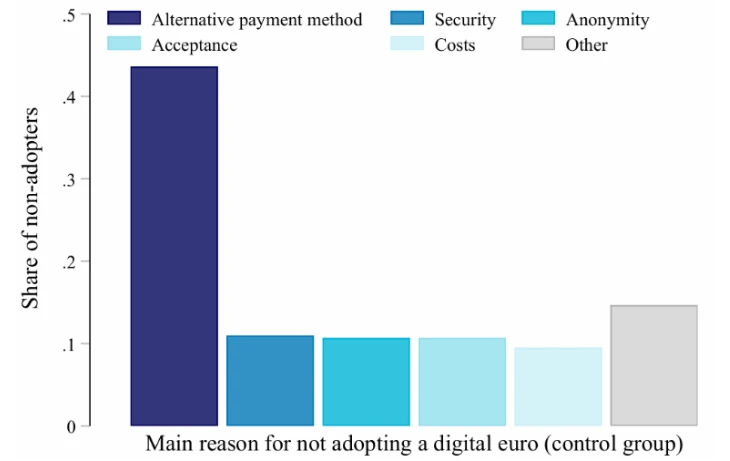

Despite years of development, a recent European Central Bank survey published on March 12 suggests that European consumers may not be interested in a Digital Euro at all. The study, covering 19,000 participants across 11 euro-area countries, found that most people still prefer traditional payment methods like cash and bank accounts.

When asked how they would allocate a hypothetical €10,000, respondents assigned only a tiny fraction to the Digital Euro, signaling low enthusiasm. The survey concluded that introducing the Digital Euro would likely not disrupt financial stability, but getting people to use it would be an uphill battle.

The ECB’s challenge now is convincing the public of the benefits. As the study bluntly stated:

“This finding also suggests that convincing some users of the value added of a CBDC might pose a challenge for policymakers, and more research will certainly be needed in this area.”

A Future Full of Uncertainty

As of March 2025, the ECB keeps moving forward with its plans, but it’s still unclear if people will actually start using it. The legal framework is nearly complete, and infrastructure decisions are being finalized, but without significant consumer interest, the digital euro might end up being a solution without a real problem.

Meanwhile, European officials are concerned about outside risks, especially U.S.-backed stablecoins growing stronger. They don’t want to lose control over the region’s financial system, which is why they push the digital euro idea. But if the ECB doesn’t figure out how to make it truly useful for regular people, the initiative might not work as planned.