Stablecoins have steadily grown into a central piece of the cryptocurrency world. These digital tokens are structured to match the value of fiat currencies, most commonly the U.S. dollar. With their fixed pricing and smooth integration across exchanges, they offer a way for traders and institutions to sidestep crypto price swings, save on conversion costs, and sometimes even earn returns.

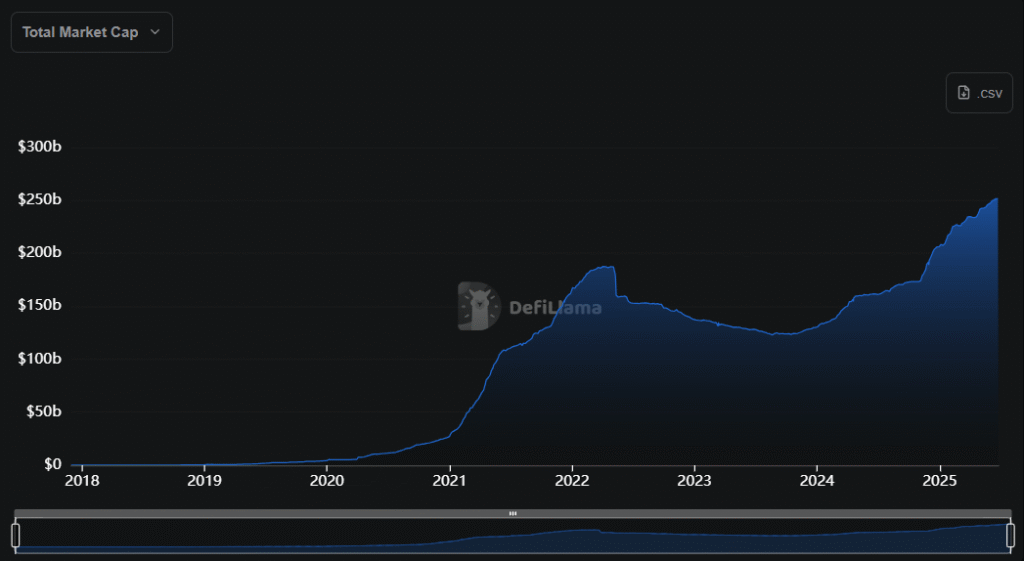

The largest stablecoins now represent over $252 billion in market value, drawing the attention of investors, regulators, and governments.

What Stablecoins Are and How They Work?

Stablecoins are digital tokens designed to hold their value against a specific fiat currency, usually the U.S. dollar. Most of them are backed by physical assets or reserves that ensure a 1:1 ratio between the coin and the dollar. This structure lets traders reduce exposure to wild price swings found in cryptocurrencies like Bitcoin or Ethereum.

There are also algorithm-based stablecoins, which attempt to keep their peg using automatic supply changes. These have faced challenges in the past, especially when market conditions create a mismatch in supply and demand mechanics. As of now, the majority of stablecoin volume comes from fiat-backed models.

Read also: The Collapse of LUNA and TerraUSD (UST) – How Did It Happen?

Large reserves and daily liquidity remain essential in maintaining trust. Platforms offering these coins often hold reserves in cash or U.S. Treasury securities. More recently, regulators have focused on creating frameworks like MiCA in the EU and the GENIUS Act in the U.S. to ensure that reserve-backed coins meet clear rules, including audits and authorization.

1. Tether (USDT)

Market Cap = $156 billion

Tether (USDT) remains the biggest player in the stablecoin world. With a total market value above $156 billion, it accounts for nearly 60% of stablecoin trading volume. Created in 2014 by Tether Limited, the token operates across multiple networks, including Ethereum, Tron, and Bitcoin’s Omni Layer.

Tether has long stated that each token is backed 1:1 with U.S. dollar reserves. However, past reports revealed that the backing included commercial paper and other short-term assets. Critics have raised concerns about the transparency of its reserve structure. Although Tether holds its place in the market, it has not secured compliance under Europe’s MiCA regulation.

The EU’s MiCA law now requires detailed reporting and asset transparency for all stablecoins offered to users in the region. Tether’s failure to meet these standards has led several EU exchanges to prepare for its delisting. New U.S. stablecoin rules, such as the Genius Act, also add more pressure on non-compliant issuers.

2. USD Coin (USDC)

Market Cap = $61 billion

USD Coin (USDC) stands as the second-largest stablecoin, with over $61 billion in circulation. It was introduced in 2018 by Centre, a joint effort by Circle and Coinbase. Coinbase has since exited, leaving Circle in full control. The coin runs on blockchains like Ethereum, Solana, and Base.

USDC has gained a reputation for its fully reserved model and regular audits. Monthly attestations from Grant Thornton provide a higher level of transparency compared to other coins. Its reserves are largely held in short-term U.S. government bonds and cash, helping USDC maintain its peg.

Unlike Tether, USDC has already received approval under the EU’s MiCA framework. This gives it a clear path forward in Europe, and it positions the coin for wider institutional use. Circle’s recent stock listing on the New York Stock Exchange under the ticker CRCL and its peak share price of $299 signal growing confidence from major investors.

Read also: Circle’s Stock Surges as Senate Clears Stablecoin Bill

3. Ethena USDe (USDe)

Market Cap = $5.6 billion

Ethena USDe (USDe) takes a very different route from the traditional model. Issued by Ethena Labs, this stablecoin does not use reserves. Instead, it uses what’s called a delta‑neutral strategy: a mix of long spot crypto positions and short perpetual futures. The goal is to create synthetic dollar parity through constant balancing.

At present, USDe holds around $5.6 billion in market value. It promises yield through futures arbitrage, which has caught the attention of traders looking for returns beyond simple holding. However, this model brings risks if market conditions shift or if funding rates turn negative.

USDe does not fall under MiCA rules because it lacks physical reserve backing. It operates outside major regulatory structures and sits in the experimental segment of decentralized finance. Past failures of algorithmic coins have made investors cautious, but USDe continues to grow in adoption within certain trading circles.

Read also: Ethena Labs Leaves German Market Amid MiCA Compliance Pressure

4. Dai (DAI)

Market Cap = $4.36 billion

DAI is the most prominent decentralized stablecoin. Managed by MakerDAO, a decentralized organization, DAI relies on a system of smart contracts and overcollateralized crypto assets to maintain its dollar peg. Since launching in 2017, it has grown to a market cap of roughly $4.36 billion.

The coin is not governed by a central company. Instead, decisions about its function and reserve policies come from holders of the MakerDAO token. It uses assets like Ethereum and wrapped Bitcoin as collateral, with automated liquidation systems to protect the peg.

Because of its decentralized structure and crypto-only collateral, DAI is not covered by the MiCA regulation. That gives it freedom from centralized control but also exposes it to higher volatility during crypto market crashes. Still, it plays a central role in many lending and borrowing protocols across DeFi platforms.

Other Major Players

Two relatively new coins – First Digital USD (FDUSD) and PayPal USD (PYUSD) – are entering the stablecoin space with a different profile. Both are issued by licensed entities and have a stronger connection to banking rules and oversight. FDUSD launched in 2025 and has already grown past $1.3 billion in value.

PYUSD, introduced by PayPal, is licensed in the United States. With PayPal’s built-in user base, PYUSD quickly reached around $1 billion in circulation. Both tokens are designed with payments and remittances in mind, rather than crypto trading or DeFi use.

Read also: FDUSD Stablecoin Suffers Depeg Following Justin Sun’s Solvency Warning

Neither coin has yet secured full MiCA approval, though both are expected to meet future compliance standards. Their transparent reserve backing and links to traditional finance may give them a path to broader regulatory acceptance.

It’s also worth mentioning the USD1, a project launched recently by World Liberty Financial (WLFI) and RLUSD, a stablecoin launched by Ripple. They are both growing rapidly in market cap and might soon become major players as well.

Read also: What is USD1? New Stablecoin Flips PYUSD and FDUSD

Regulation Is Reshaping the Stablecoin Sector

New rules across the U.S. and EU are transforming the way stablecoins are created and offered. The EU’s MiCA law came into effect in December 2024 and sets new conditions for any asset-referenced token in the market. MiCA demands that stablecoin issuers hold adequate reserves, pass audits, and register with authorities.

USDC and the euro-pegged EURC are already operating under this legal framework. Tether has not achieved compliance, leading to concerns over its future availability on European platforms. Meanwhile, decentralized coins like DAI and USDe remain outside the scope due to their unique technical setups.

In the U.S., the Genius Act, passed on June 17, 2025, calls for reserve holdings in liquid U.S. Treasuries and stricter audit practices. These legal moves are signaling that regulators want better stability and accountability in the growing stablecoin sector.